You may have already heard about SafeMoon, a cryptocurrency created earlier this year that has been doing the rounds on Twitter, Reddit and in the pages of various newspapers. If you haven’t, it’s probably only a matter of time as celebrities and influencers with millions of followers such as Lil Yachty, KEEMSTAR, and Jake Paul promote the investment that for critics is bringing up memories of infamous scams of cryptocurrency’s recent past. Just what the hell is going on?

SafeMoon is a cryptocurrency token that promises potential investors the moon—that is, when a token reaches a sky-high value. The idea is that Safemoon will reach the moon “safely” (get it?), its creators say, by exploiting the Rube Goldberg-like mechanics of programmable tokens and a critical mass of social media-driven investment to boost its value. To some, it’s an opportunity for profit, but to many it looks a lot like a complicated and risky scheme just waiting to crumble into a mess of broken dreams.

Videos by VICE

SafeMoon is designed to discourage selling by levying a ten percent tax on sellers. Of that ten percent tax when someone sells their SafeMoon, five percent is distributed back to current holders, and the other five percent is destroyed, reducing the supply and supposedly driving up the price. That’s pretty much it, and it’s cannily similar to a ton of other cryptocurrency projects for which holding generates continual interest, a process known as “yield farming.” With SafeMoon, however, a lot of money has to pour into the cryptocurrency for it to produce any benefit for its holders, as well as anybody who wants to eventually cash out their holdings when the potential gains surpass the loss from the sale tax.

In other words, SafeMoon openly exhorts its investors to convince others to pile in and hold, a dynamic that is inherent to pretty much all cryptocurrencies, to a degree, but which hype-hungry SafeMoon takes into Herbalife territory. It even has merch.

SafeMoon launched in early March, has not yet been listed on any major exchanges (making it only possible to buy via a pretty complex process involving another token and a swap), and has produced an entirely speculative roadmap which includes plans to expand into Africa and the U.K., fund a SafeMoon charity, and build an “educational app.” But it is alarming to see how this convoluted and high-risk financial product has been buoyed by celebrities and influencers with millions of followers convincing their fans to buy the token.

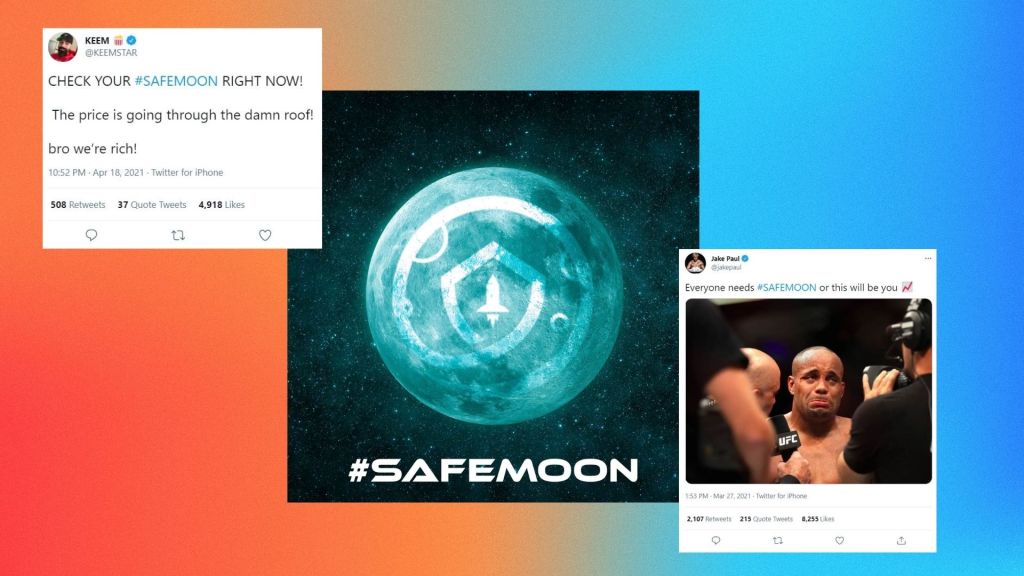

Daniel Keem, also known as KEEMSTAR, runs a Twitter account with over 2 million followers and owns the DramaAlert YouTube channel, which has more than 5 million subscribers. Keem has been promoting SafeMoon relentlessly on social media and appeared jubilant last week when it surged, telling his followers they would soon all be very wealthy indeed: “CHECK YOUR #SAFEMOON RIGHT NOW! The price is going through the damn roof! bro we’re rich!” Keem tweeted. That tweet generated five thousand likes, with hundreds of people commenting under it asking desperately how to invest in the coin, which since last week has already lost over three quarters of its value.

Keem is not alone in promoting SafeMoon, either: rapper Lil Yachty (5.4 million followers) has been promoting SafeMoon on Twitter, and so has YouTuber-turned-stunt-boxer Jake Paul (3.9 million followers). Beyond influencers and celebrities, SafeMoon even managed to pick up some largely uncritical write-ups in Newsweek, the Scottish daily The Scotsman, and the UK’s Daily Express.

SafeMoon, however, has not seen smooth sailing. The development team hosted an AMA on Twitch in mid April that was freewheeling and more than a little bizarre; the developers spent the majority of the stream congratulating themselves on their token’s success, while failing to assuage concerns from investors about network outages and the project lacking fundamentals. The display even turned Keem off of the coin briefly, tweeting, “Did not like that stream im getting out of #SAFEMOON.” Later that day, Keem tweeted that he was back in but with a smaller investment.

Others haven’t been so easily placated. Due to the fact that profiting from SafeMoon depends on more investors piling in after you, critics have said it’s reminiscent of incidents like the infamous Bitconnect Ponzi scheme that imploded in 2018. Even some SafeMoon investors are remaining vigilant for signs of a “rug pull,” also known as an exit scam, which is when a project’s creators run off with a hoard of valuable tokens (SafeMoon’s developers promise they “burned” their stash to ensure a fair launch).

According to Colin Platt, a cryptocurrency researcher and the chief operating officer at Unifty, a marketplace for NFTs, SafeMoon is exploiting mechanics and buzzwords from the trendy world of decentralized finance (DeFi) to promote what is plainly a get-rich-quick scheme built on a messy mish-mash of code.

Because the mainstream “only hears about legitimate things and absolute scam bullshit like Dentacoin,” said Platt, cryptocurrency devs have a tendency to litter projects with keywords laden with viral potential, not unlike old-school email spammers. “It’s like when WiFi first came out,” he said. “Every project suddenly took some derivative of the word ‘Wi-Fi,’ so you had projects called Wi-Fi-X, X-Fi, Wi-Wi, X-Fi, etc. Similarly last year, in crypto, they started prefixing things with the word ‘safe’—SafePal, SafeBTC, SafeUniverse, SafeMoon, whatever—and sometimes they get traction.”

“That’s how this thing works,” he said.

DeFi is a movement of developers building complex, Ethereum-based financial services that don’t require a bank. Critically, DeFi projects aim to be pretty much entirely automated, letting code fill in the place of a human behind a desk making decisions. Importantly, then, and out of step with other DeFi projects, SafeMoon’s development team manually controls coin burns.

SafeMoon also runs on “Binance Smart Chain,” or BSC, a cheaper iteration of Ethereum developed by Binance, a major cryptocurrency exchange. It is cheaper because Binance bankrolls it and delegates control of nodes to entities it influences, sacrificing much of the “decentralized” appeal that Ethereum brings but making it more convenient, and saleable, for developers on a budget. Indeed, SafeMoon can only be purchased after first buying BNB, the in-house token of BSC.

Frequently, DeFi projects are just get-rich-quick schemes veiled in glossy, impossible-to-parse technological language. But at least some are, genuinely, striving for a higher purpose. With SafeMoon, there is only the promise of easy riches, and a technological base layer which is surprisingly arcane.

For instance, Platt took a look at the SafeMoon source code, and found that it was actually a “fork,” or copy, of another project called “BEE,” which itself was a hodgepodge of elements culled from four similar projects: Liquid, Shiba Inu, Reflect.Finance, and the recently parabolic Dogecoin, another viral “meme-coin.” It was Reflect.Finance, for instance, which pioneered rewarding holders; other elements of SafeMoon have been similarly appropriated. Platt also speculated that “BEE” might have been a previous iteration of SafeMoon that the devs forgot to cut from the code.

“All of these ideas,” said Platt, “are just a mishmash of other ideas that are out there already and never got any play.”

SafeMoon’s developers did not respond to Motherboard’s request for comment.

The wild world of cryptocurrency is no stranger to complex schemes that aim at generating huge returns. Some of these, like Bitconnect, are flatly fraudulent. Other schemes straddle the line between grift and gamble and even revel in the grey zone; in 2018, for example, a gambling “game” called Fomo 3D became popular and saw users scrambling to be the last to purchase a “key” before a timer ran down to secure a payout from a pot of everyone else’s money. That project advertised itself as a “psychological social experiment in greed.”

What is undeniably brilliant about SafeMoon is that it couches the promise of wild gains in language which is at once high concept and transparently superficial. The stated purpose of the token is to “yield farm,” to “lock in value,” to develop circular “educational” content, all of which serves to produce a perpetual motion machine of holding, selling, taxing and rewarding that forms its own kind of pointless ecosystem, shuttered away on some speculative moonbase, entirely self-contained in the cold vacuum of crypto space, one small step for profiteers and a pratfall for mankind.