I bought a little under one bitcoin (about 0.85 BTC) cheap, once; “cheap” by today’s standards, anyway. It cost around $400 USD, from what I remember. For two years it sat in a wallet as I waited for my big payday—the day when Bitcoin’s price hits however many hundreds of thousands it will take to not see John McAfee eat his dick—and I could cash out.

As I waited, I thought about how people were investing in that day’s most important cryptocurrency, which was once the butt of dismissive jokes about libertarianism. Seemingly everyone who didn’t invest earlier was now just trying to make a quick return on a pricey investment before entirely exiting their position. More logical, I thought, was to put money into something that’d return gradually, avoiding crashes and still pocketing bitcoins that could be sold at the most opportune time. I wanted in, but not in a way that meant that I was going to be constantly buffeted by Bitcoin’s volatility.

Videos by VICE

With my one bitcoin just sitting there, I decided to run an experiment.

After taking a (legally-prescribed) Concerta and muttering, “It’s time for some game theory,” I was reminded of playing a game of Craps. At a typical Craps table, there are those who bet on the six, eight and the pass line (with odds) and hope to not “seven out.” There are those who put lower amounts on the hard ways—two twos, threes, fours or fives—hoping that a “soft” version of four, six, eight, or 10 won’t roll, or indeed a seven.

So I wondered, what if I tried playing with Bitcoin like I’d play at a Craps table? I’d bring a bankroll, I’d find a strategy that let me grind away and minimize losses, and hopefully not lose every cent I had. To be clear: I’m not saying you should do this. I just saw it as the least stupid way to get on the table. And, maybe I’d learn something about how this all works and where it’s going.

*

The mainstream reaction to Bitcoin and other cryptocurrencies has been frothy—the hooting table in Vegas that attracts your attention. The difference between digital currencies and a casino table, though, is that there’s very rarely (at least with the most popular cryptocurrencies) a full “loss.” Sure, there are those who purchased Bitcoin at $19,500 and watched as a week later it sat around $14,800, but it was still just a 25 percent drop and they still owned a bitcoin.

Enter mining, the process that generates new units of cryptocurrencies. I don’t really understand the actual technicalities of it, but mining requires super-fast computers that do one thing: mine Bitcoin. A roughly $7,000 Antminer S9 can put out around 13.5 TH/s of hashrate (a term for how fast it mines). Depending on the mining difficulty of the blockchain and the price of Bitcoin, this can make you around $654.01 per month in profit. (Note: all calculations are based on a $15,000 Bitcoin price.)

Bitcoin mining made more sense to me than buying and selling it, in terms of playing the odds. It was the grind of a Craps table—a layout that pays more (statistically) while also hedging your bets against a seven, the Bitcoin equivalent being a price crash. It’s hard to find an exact analogy, but mining is like the reverse-style of craps that bets money on sevens rolling early and often.

A couple hard realities put a wrench in my plan, though. Mining machines sound like miniature jet-engines and can rack up a significant electricity bill, meaning that you can’t just stick them in your home computer room (unless you are very tolerant of sound). You could build your own, or maybe even sell your house to cover your costs, but to me they seemed like complex, power-hungry, and potentially explosive devices.

So, I decided to take my betting money and put it in the cloud.

*

The cloud mining space is a worrying, potentially scam-filled Hell.

Cloud mining works similarly to other cloud-based services like data storage: Someone else owns the computers, and you’re just paying to use them for a while. The two most popular companies offering the service—Hashflare and Genesis Mining—stood out only because I found some evidence of payouts online. Both have gaudy marketing. Genesis Mining declares that you can “START BITCOIN MINING TODAY!” despite not currently selling Bitcoin mining contracts (only, as of this writing, Monero, and Bitcoin contracts are marked as being “out of stock”). Hashflare offers “unbeatable” features like 24-hour payouts, instant withdrawal and “detailed statistics.”

In both cases there are minimums you have to accrue before you can withdraw your profits—Hashflare’s currently sits at 0.05BTC. Genesis Mining has a number of different payout minimums, depending on the currency you’re mining. There’s also withdrawal fees, required because of the transaction fees associated with moving cryptocurrency. Individual withdrawals generate a new transaction, meaning more fees, hence the minimum withdrawal amount. Finally, there’s a small daily fee based on how much mining you do. By my math, a 10 terahertz per second Hashflare account will produce around $19 per day, but you lose roughly $3.50 in fees.

I’d oscillate between “I’m the brain genius for having my monster cash-engine building” to “I could have magically had $17,000 and not spent any of my actual money if I just cashed out my bitcoin.”

One worrying thing about this scenario (from a gambler’s perspective, anyway) is that ultimately you are beholden to the mining difficulty of the blockchain—which tends to go up over time, meaning that you will mine less Bitcoin eventually—and how much you can withdraw at a given time. There may come a point when your year-long cloud mining contract ends, and you don’t meet the minimum to withdraw your profits.

Many Twitter users have voiced their concern about this. In Hashflare’s defense, it’s been incredibly expensive to do a Bitcoin transaction for months, and in December, one transaction cost an average of $28 to push through the network. The company is also investigating ways to bundle withdrawals to lower fees.

The thorny math and small print made it all seem a little shady, but on December 11th, I bought my first mining contract with Hashflare. I spent the next day reading numerous “SCAM! SCAM!!!!” tweets and watching a sea of stock-photo-avatared YouTube videos that don’t exactly help the case for cloud mining being legitimate, nor did the stream of people suggesting you sign up immediately using their 10 percent-return referral code.

I was kind of freaked out.

*

I initially bought two separate year-long 15 TH/s contract for $2,250 each with a credit card. I told a friend at the time that I’d either been scammed and the money was gone anyway, or I’d not been scammed and I’d have better returns later if I bought more hash power. So, in the time before my first withdrawal I decided to put my bitcoin into buying a further 100 TH/s, which translated, at the time, to roughly $15,000. Remember, I’d purchased my bitcoin for a lot cheaper than that.

I pumped in another $4,530 worth of Bitcoin that I’d just bought, like an excitable gambler throwing more chips on the felt.

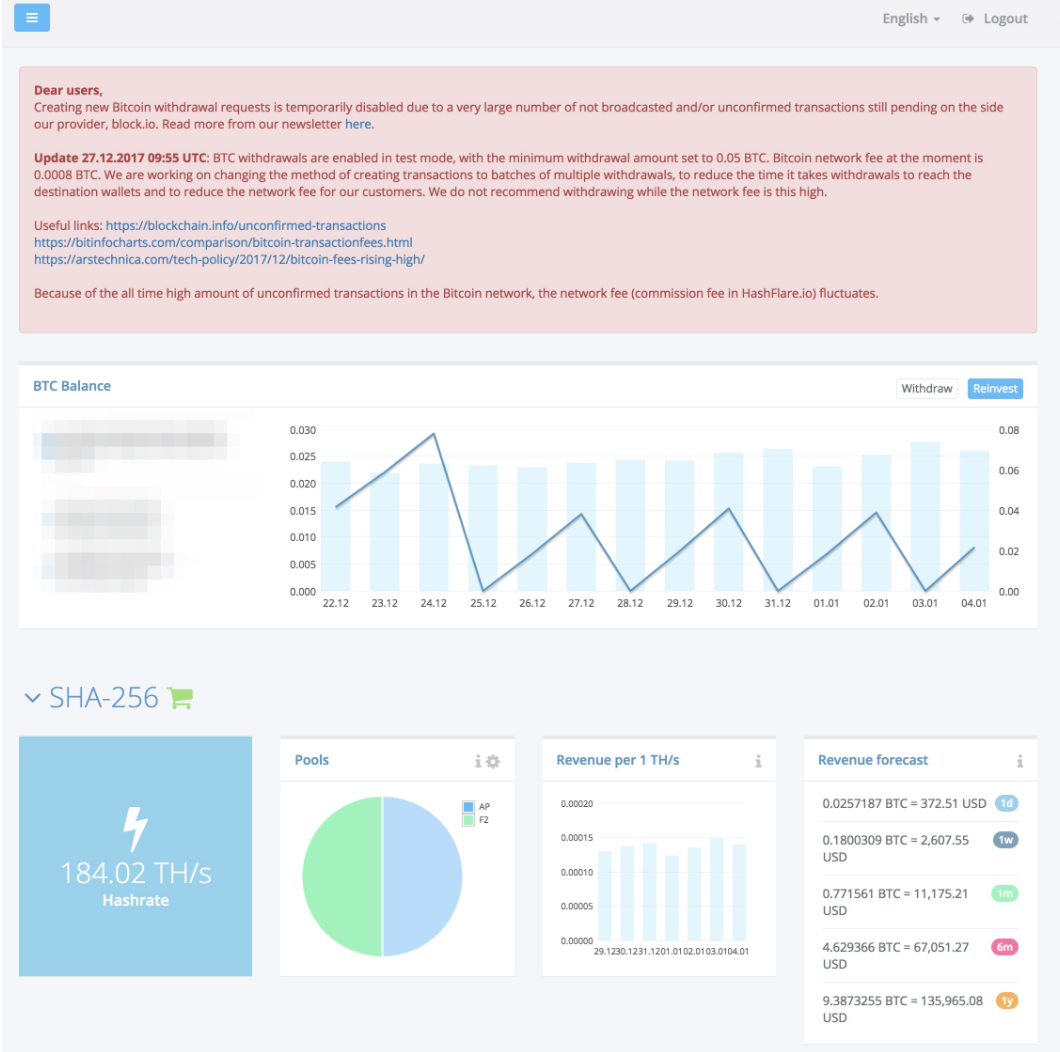

Within the time that I bought my first contract and built up my hashrate—about a week—Hashflare stopped withdrawals entirely, the blockchain became way, way more difficult to mine, and Bitcoin dropped in price. But the grind continued.

During this period, I obsessively checked my inaccessible payouts every day, reinvesting them and reassuring myself. I’d oscillate between “I’m the brain genius for having my monster cash-engine building” to “I could have magically had $17,000 and not spent any of my actual money if I just cashed out my bitcoin.” I pumped in another $4,530 worth of Bitcoin that I’d just bought, like an excitable gambler throwing more chips on the felt.

On December 17th 2017, Hashflare (briefly) suspended withdrawals. For a few days, I kept reinvesting simply because it felt like a video game that had cost me five figures than gambling with real money. When Hashflare re-opened withdrawals, I stopped reinvesting and waited for the day when the withdrawal button would turn blue—which ended up being Christmas Day.

Before that, though, my best friend, health physicist and coffee-maker Phil Broughton, told me that this was all a decent betting strategy, but reminded me that it was gambling and to treat it as such. My father told me it sounded “reasonable,” which is British for “not completely stupid.” Everything up until now seemed to check out, but I was still scared. Who wouldn’t be?

It paid. When I was able to finally withdraw, my mining payout was 0.09587047 BTC. The withdrawal button worked, and the BTC arrived in my Coinbase account. I moved it over to GDAX (Coinbase’s platform for professional investors, which for some reason doesn’t have Coinbase’s normal fees), sold it all as BTC’s price briefly hit around $16,000, and pocketed $1,540.32, about a 6.6 percent return on the total I invested.

Even though I got my first payout, the constant increase in the blockchain’s mining difficulty and fluctuation in Bitcoin price makes it hard to say whether reinvesting was the best idea. According to the most conservative estimate I can make—low mining amount per day, harder blockchain—it will take me at most three months to recoup my entire investment, dollar-for-dollar. From then until the end of my contract in December of this year, I will, in theory, be making pure profit.

This assumes a few things, though. Bitcoin is volatile enough that it could shoot up to $19,000 per bitcoin again, or down to $10,000. Or worse. Hashflare could halt withdrawals, or the blockchain could become incredibly difficult, to the point where I’m not making nearly as much. I’ve got a year to at least break even before my mining contracts are up, though.

*

So, it’s still early but it looks like my gamble is going to pay off. But something troubles me about it. Throughout this process it seemed like mining—both in the cloud and on-premises—was yet another way in which cryptocurrency would enrich those wealthy enough in real dollars to invest five (or six) figures.

While everybody on the blockchain is subject to the same math, someone with $220,000 to put into a 1,000 TH/s worth of hashrate could make about $1,650 per day after $350 in fees. That same person, if Bitcoin then rose from $15,000 to $17,000, would have exponentially more liquidity than anyone who can’t put down at least four figures. Sure, everyone’s bitcoin goes up in price the same, but it’s still a perfect “the rich get richer” scenario.

We’ve gone from the Craps table and into the depths of Galt’s Gulch.

Although Bitcoin mining can technically be done by anybody, in reality a handful of large companies dominate the space with gigantic server farms located everywhere from Canada to Inner Mongolia. Succeeding in mining is a game of scale, and the company with the most, and fastest, computers will win more often and mint more digital coins.

In the future, one can imagine a Goldman Sachs or Kleiner Perkins (or even just a rich person) spending many millions of dollars on tons of Bitcoin rigs and running them out of warehouses. Not only would this enrich established players many fold, but it would give them a degree of power in deciding the rules of the Bitcoin blockchain, or to bootstrap a new blockchain with new rules that favour them.

While there are people out there who may see purity in this future, excited at the idea of Bitcoin’s infrastructure being decided by Wild West free market dynamics, I see Bitcoin’s current mining system as a way for the blockchain rich to get richer. The irony of me even saying this is that I had the money to invest in the first place. Am I part of the problem? When do I become part of the problem?

Maybe Bitcoin’s future is in highly centralized, ultra-powerful mines. When the 2020 halving comes (when the reward for mining blocks of Bitcoin data is halved) and the last of the small outfits drop out of mining due to a sheer lack of profitability, the blockchain will end up stacked heavily in favor those who have acquired vast resources of cloud or on-premise computing.

There will be a new class of crypto-capitalists; they own the sole means of Bitcoin’s production. “Gold rush” is a wonderful cliché to apply, if only because I think we’re in the middle of one—regular people can ostensibly still mine for now, if they’ve got the cash and the gumption, but we’re going to get to a time when only lumbering corporate giants can get anything of worth at all. The fact that a single company—Bitmain in China—sells the majority of everyone else’s mining equipment and mines Bitcoin itself could be an early sign of this trend.

In any case, there is no turning back from this point. I’ll probably turn around a healthy profit and be happy with that. Others will too. But in two years, where will we be? In two years, where will cryptocurrency itself be? Will it even be worth calling it crypto currency? Some people already say no. Or will they simply be crypto-entities, traded for money, enriching those that can afford to invest ridiculous sums? We may even really be at a point where people who couldn’t invest and enrich themselves before are finally having a chance, but the sun is setting.

And with it, a beautiful future.

Ed Zitron is the founder and CEO of EZPR. Some of his clients include companies working in the cryptocurrency industry—but none of them mine cryptocurrency, in the cloud or otherwise.

More

From VICE

-

Vinay Gupta: "People are too stupid to understand they're being handed a solution" -

-

-