It is FAR from an overstatement to say that Vancouver is an unaffordable city for most Canadians. And it’s for one reason, and one reason only — housing.

I cannot begin to emphasize how absurd rentals have become, across the Metro Vancouver area. According to data from Canada Housing and Mortgage Corporation (CMHC), rents in Vancouver increased 6.4 percent in 2016 alone. That does not sound like a lot, but consider that the B.C. government imposes a regulated cap on annual rent increases of 2.9 percent. Not only does a six percent rent increase far outstrip that cap, it’s been an ongoing trend in Vancouver over the last decade or so. In 2015, for instance, rents rose four percent, and the year before that, they rose four percent too.

Videos by VICE

(Just for the sake of comparison, rent in the Greater Toronto Area increased three percent in 2016, but that only takes into account rent increases in buildings built prior to 1991, which are subject to rent control.)

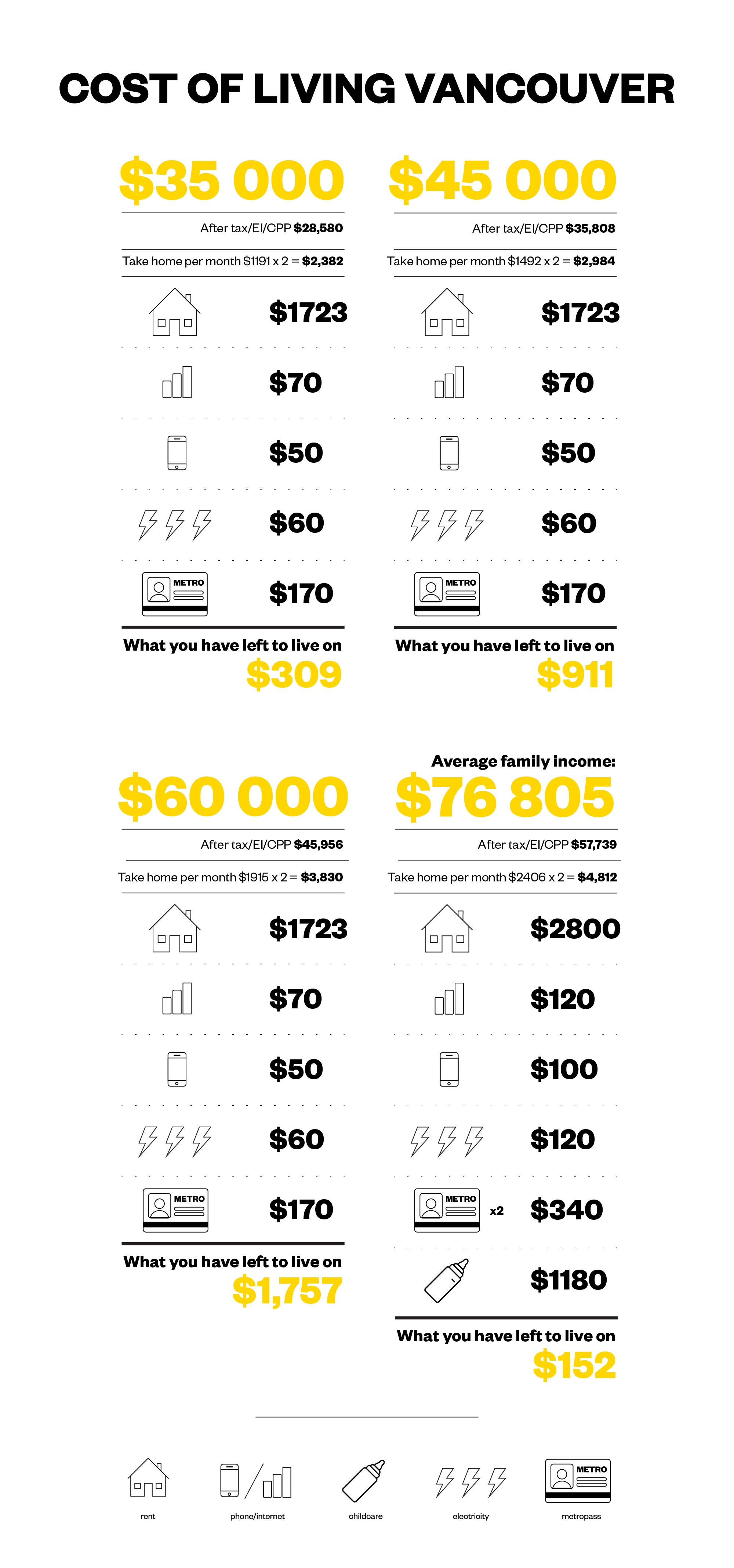

Before I get into the nitty gritty of Vancouver’s preposterous housing and rental market, take a look at this breakdown of what you’d need to live in this city, depending on how much you earn.

Now it’s clear that that your biggest monthly expenditure is rent. These rent figures come from rentboard.ca — they reflect, most accurately, what current rents are in Vancouver, based on my searches for one bedroom apartments on Craigslist, Kijiji and viewit.ca.

It costs an average of $1723 to rent a studio/bachelor apartment — $1900 is the average rent for a one bedroom apartment. If you’re earning a salary of $30,000 to $50,000 it will be a financial squeeze to live alone — you’d certainly have to look for a roommate. Say you did have a roommate and you lived in a two bedroom apartment, you could still be paying up to $1500 in rent per month, a figure that is way above the amount you should be spending on rent.

Frankly, the only way you can afford to live in Vancouver on an average salary ($50,000), is by sharing an apartment with your partner, or carving out space in your living room for a roommate — the latter situation is frequently discouraged by condo corporations and landlords who see overcrowding as a dent on the potential resale value of their unit.

The story behind Vancouver’s rental market increases is very much tied to vacancy rates, meaning, the number of apartments and condominium units available on the market to rent out. The latest CMHC figures peg vacancy rates in Vancouver at an abysmal 0.7 percent, the lowest it has ever been in the city. In fact, one Vancouver neighbourhood located next to the University of British Columbia (University Endowment Lands) recorded a vacancy rate of zero percent in November 2016. The reason why this is so troubling is because a vast number of houses in that area are student rentals, meaning that students will now have to opt for more expensive private apartments and condominiums to live in.

Vancouver’s Mayor Gregor Robertson calls the rental situation a “crisis” — he recently imposed a tax on vacant homes to incentivize homeowners to rent out underused investment properties, that often act as vacation homes for some, or just an asset to park extra cash.

It’s unfortunate that the housing situation has gotten so dire in Vancouver. Buying a house is virtually impossible for many young people, considering that the average price of condominium unit in Metro Vancouver is upwards of $500,000. That leaves renting as your only option, and so you’re basically priced out of the market if you earn anything less than $60,000 per year.

Follow Vanmala on Twitter