Want the best of VICE News straight to your inbox? Sign up here.

New COVID stimulus checks are on the way. But exactly how much you’ll get depends on the fine print—and on the next round of political bickering.

Videos by VICE

The government will begin sending out paper checks to Americans on Wednesday as part of the new $900 billion emergency stimulus package, Treasury Secretary Steven Mnuchin said late Tuesday. President Trump had signed the law on Sunday night after a five-day delay, and some electronic deposits might have arrived as early as Tuesday night.

Generally speaking, adults and children will get $600 each. But the payments remain subject to intense political feuding between Democrats and Republicans that could easily continue into early 2021.

That means there’s still a question mark over exactly how large the checks will be: President Trump and Sen. Bernie Sanders, an Independent from Vermont, along with Democrats in the House, are trying to triple the topline amount to $2,000. Language included in a bill recently passed by the House would raise payments, but the Senate hasn’t yet approved that provision—and they might never.

For now, here’s how much you can really expect—and the key unknowns going forward.

Here’s what “$600” really means

Broadly speaking, individuals making less than $75,000 a year will get the full $600 payment, and the feds will hand out another $600 for each dependent child under 17.

The $600 in this round is half the $1,200 that the feds distributed to adults in last spring’s CARES Act. On the other hand, dependents aged 16 and under got only $500 during the last round.

The value of the checks incrementally declines for individuals making more than $75,000 a year and eventually drops to zero for those making above $87,000.

Married couples filing jointly will get $1,200 if they earn less than $150,000, and their benefit zeroes out above $174,000 in joint income.

Individuals filing as heads of household, like single people with children, will get the full benefit if their income is less than $112,500.

For both individuals and joint filers, the benefit falls by $5 for every $100 more in annual income above the threshold level, until it reaches zero.

There are some handy online calculators for those who want to check their math, including here and here.

Bad news for college kids

Some important groups of people are being left out in the cold—including “adult dependents” 17 or older.

That cohort includes millions of college and high school students, disabled adults, and older Americans who are being cared for by a family member.

Naturally, excluding college students listed as dependents on their parents’ tax returns has caused a lot of consternation on social media from grumpy collegiates, who’ve been having a hell of a time dealing with the pandemic already.

This exclusion might be reversed, though. Language in the bill that recently passed the House would cancel it and also bring adult dependents back into the fold.

So what’s next?

Trump is demanding Congress raise the value of the checks from $600 to $2,000 per person. The details of exactly how that would work remain to be seen in the finished language of the final legislation.

Trump’s position is supported by an unusual coalition of Democrats and a few Senate Republicans, including those who happen to be up for reelection in the all-important runoff in Georgia on January 5, which will determine whether Democrats or Republicans control the Senate.

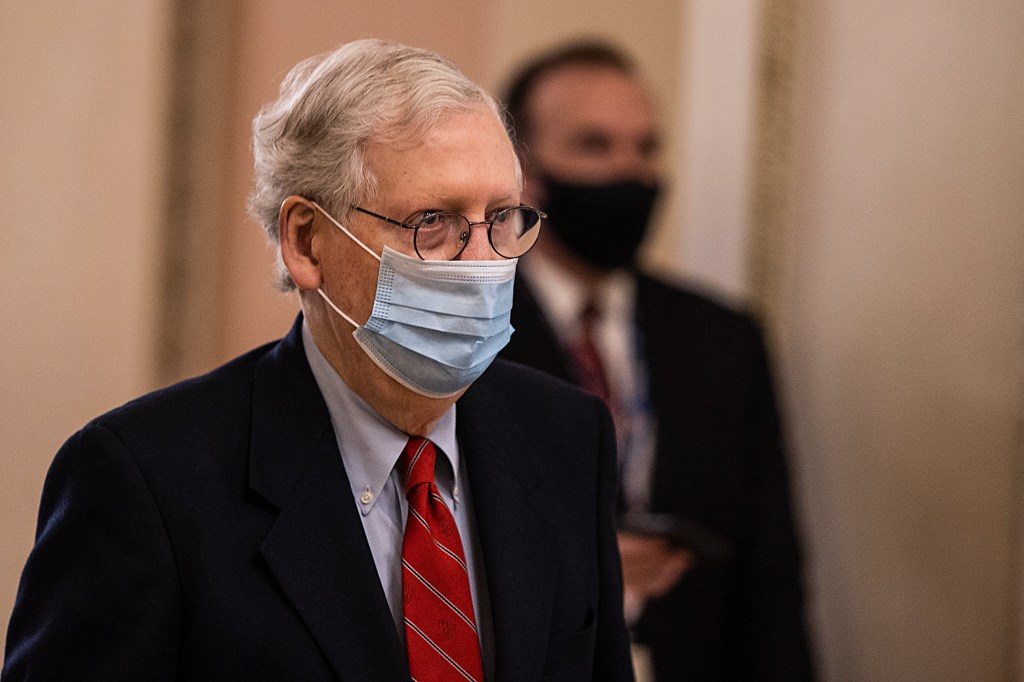

But for now, the wily GOP Senate Majority Leader Mitch McConnell is blocking a straight vote on the increase alone while attempting to tie the boost to stuff that Democrats don’t want (specifically, new regulations for social media companies and fresh action on Trump’s groundless claims of voter fraud).

Pressure is now building on McConnell. And the big question will be whether, and how long, he can resist the wishes of Trump and those of his fellow Republicans, who favor the increase.