Weeks ago, when I first saw the term NFT, I guessed it had something to do either with the NFL or cryptocurrency. As an exercise-phobic indoor kid with zero understanding of “finance”, I intentionally paid no attention to it.

Turns out I probably should have done. Having followed the work of digital and augmented reality artists for a while – and with the news that Grimes had made $6 million selling NFTs – the topic became inescapable on the parts of the internet where I tend to lurk.

Videos by VICE

Not wanting to be the last kid picked to play football, I made my housemate explain the basics. Bear with me – here’s what I learned:

Cryptocurrency operates using blockchain technology. A blockchain is a type of database that stores data, in blocks, which are chained together. The database is controlled by all users, not specific people or groups, and all transactions on the blockchain are recorded permanently and can’t ever be edited. Transactions are recorded with an immutable cryptographic signature, or a “hash”.

Non-Fungible Tokens, or NFTs, are unique cryptographic tokens powered (mostly) by Ethereum, the second biggest cryptocurrency after Bitcoin. Essentially, they’re bits of unchangeable code that prove you own that specific jpeg, GIF or Azealia Banks audio sex tape.

While you can’t trade these interchangeably, as you would with a crypto coin, you can resell them as they rise in value, in a similar way to flogging “y2k rare vintage gems” on Depop, or how you’d casually inflate the price of a rare paintbrush in your Neopets shop.

Obviously people can screenshot a picture of the NFT you own and share it how they please, copyright laws provided, but it’s not the same as knowing, deep down, that you’re the genuine keeper of the real thing.

“Having so many people locked in front of their computers for indefinite periods, and the inability to travel and visit cultural institutions, played a significant role [in the rise of NFTs],” said Elena Zavelev of CADAF (Crypto and Digital Art Fair). “Digital art has traditionally been a niche segment of the art market, showing lower prices and fewer works in the art collections.”

The sudden jump in value of these usually forgotten artworks has organically created a buzz for NFTs among digital artists, especially as the technology allows for the original artist to earn a cut every time the work is sold. “2020 became a pivoting point, with a lot of hype around crypto on the one hand, and the proliferation of digital art among the creators,” said Elena.

While Elena admits that what ends up selling is entirely down to collectors’ tastes, a scour of NFT marketplaces like Rarible, Foundation and SuperRare reveals that the top performers tend to be animated 3D renderings and internet-culture-inspired imagery. Artists I’d been following on Instagram, including Serwah Attafuah, Kyt and Emma Stern, had all recently sold their hyper-femme digital pieces for thousands of dollars. It’s exactly what you’d expect from an art market dictated by a bunch of internet nerds.

“The platforms you mentioned, and many more, offer a straightforward process on their marketplaces, requiring zero coding skills,” Elena explained. “Since the space is so hot right now, there are often long waiting lists for artists to sell their art.”

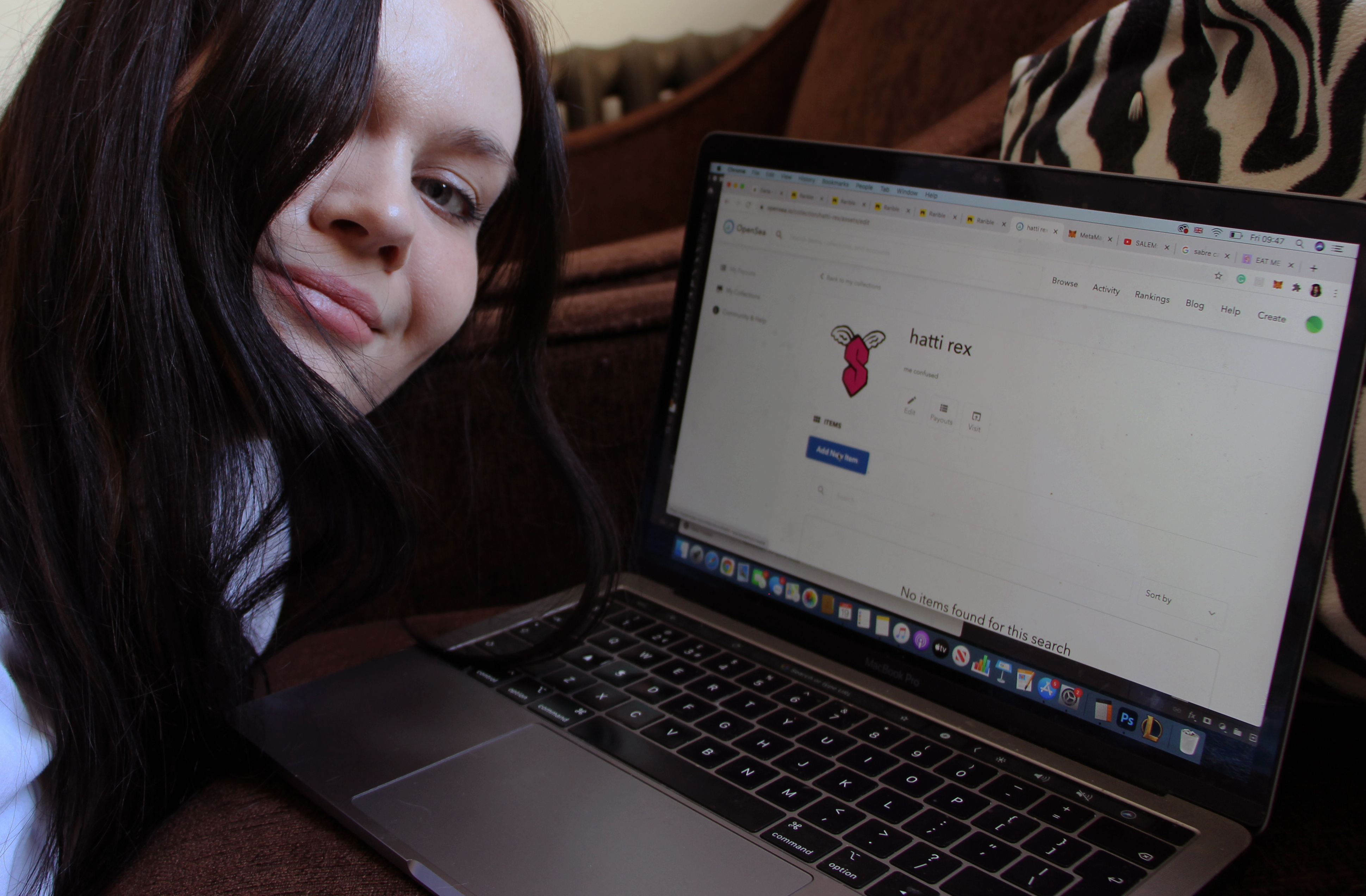

One platform without a waiting list is OpenSea, the “world’s largest digital marketplace” for NFTs, which houses infamous (in the NFT space, at least) collections like CrytoPunks and CryptoKitties. As an impatient writer on a deadline, I figured this would be my best chance at making it big as an NFT artist.

First of all, I had to buy some Ethereum, the cryptocurrency responsible for upholding this blockchain art market. Luckily, my aforementioned housemate had a referral deal at Coinbase, a digital wallet where you can easily buy, sell and store various forms of crypto. Once the currency was purchased, I had to transfer it to Metamask and add the app to my browser. If you’re still following, congratulations.

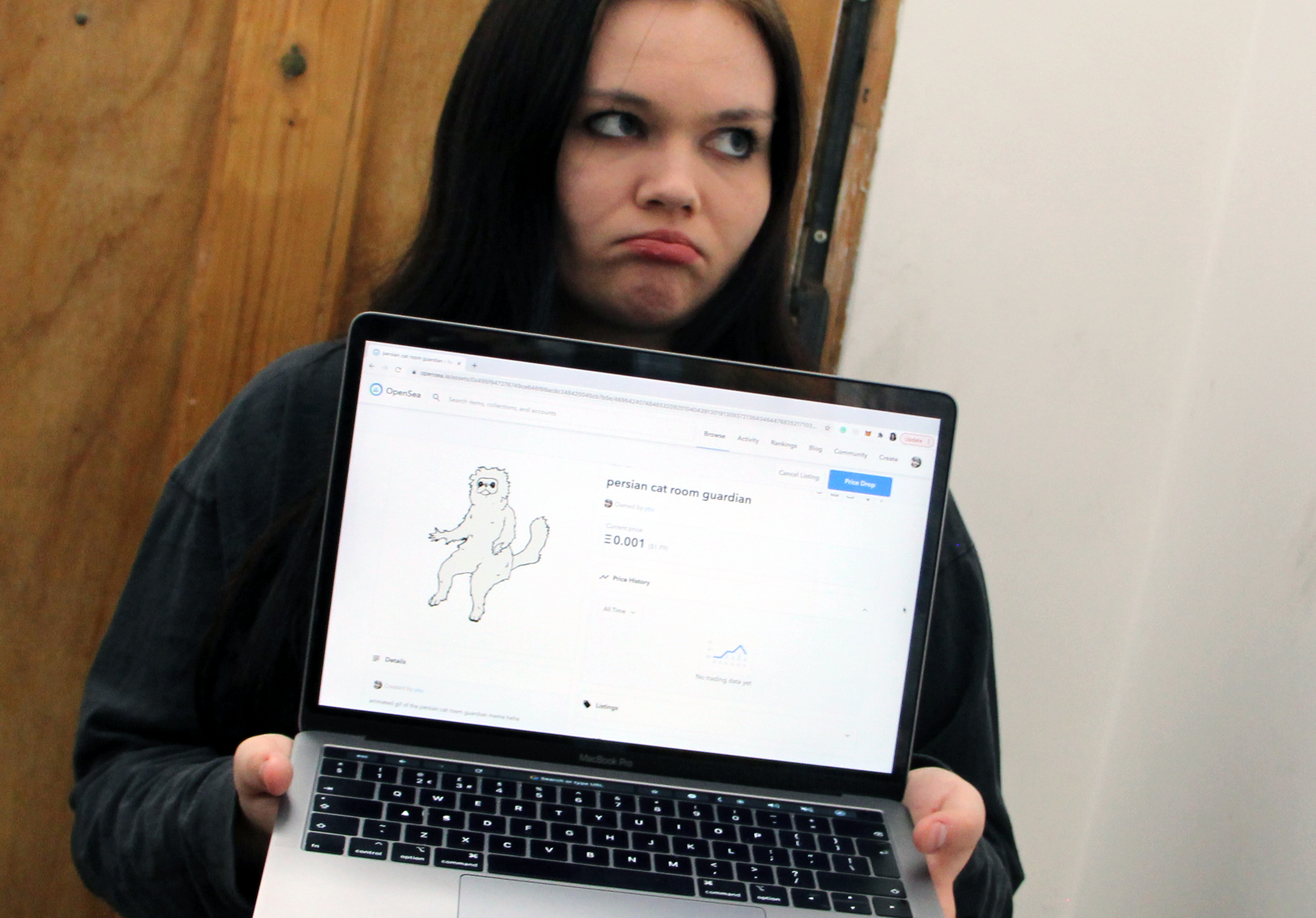

Next, I had to choose which silly little doodle from my desktop to actually make – or “mint” – into an NFT. Presuming internet jokes would always do well, I picked an homage to that cursed “persian cat room guardian” I made a while ago, which had already picked up over 7 million views on Giphy.

Despite having no experience making anything remotely like a 3D fantasy landscape, surely this humble recreation of a meme would be a surefire way of earning the big bucks. I hoped so, as I was charged a 0.066156ETH (£86.92) “gas fee” for the minting process.

While you can just have a piece sitting on the platform indefinitely, gathering dust until it’s finally sold, lockdown three was getting to me. Craving the eBay-esque adrenaline rush of auctioning my GIF to the highest bidder, I set the time limit to three days and waited. And waited. And waited. And waited.

On day two, I dropped my starting price to the equivalent of £25. Even if it sold, I’d be selling at a 71 percent loss, so I reached out to Elena again for some advice. “I think it’s not the right time for the piece then,” she said, kindly. “I feel that it’s most productive to look at all of it as you’d treat any new genre, really, just very much like in traditional art.”

Just like that, it became clear that I didn’t really know what I was doing. Unsurprisingly, my silly little GIF didn’t earn a single bid.

It seems as though I’m not the only one to suffer this fate; even Beeple, an artist who recently sold an NFT for £50 million, has said the crypto-art boom is a “bubble” – and there are plenty of warnings online about spending more minting the thing than you’ll ever make off it (which, of course, is exactly what I did). And that’s before you even consider the other downsides, like the massive environmental impact of cryptocurrencies, or the fact that fraud in the NFT space is already rife, with people minting artworks and selling them without the original artist’s permission.

Still, if any edgelord collectors want to buy the last shred of my dignity, it’s currently for sale on OpenSea at the equivalent of £1.25. Such a bargain, proper nice as well.

UPDATE: After this article was published, the NFT was purchased for £1.18, leaving me with a loss of just… £85.74.

In conclusion: selling NFTs clearly isn’t the lucrative locomotive to Big Bucks Town that many have claimed it to be. Perhaps next time I’ll try something more financially viable, like dropshipping, or a multi-level marketing scheme. Or maybe I should learn how to use 3D software… or give up on drawing, forever?

See what this process has done to me? I’m a wreck. This huge anticlimax has left me with a worrying gut feeling that I should never shoot my shot again, and that also, deep down, I’m as much of a capitalist girlboss as the rest of them. After all, I chose the NFT life, it didn’t choose me.

More

From VICE

-

Amy and Stephen Allwine on their wedding day. Years later, Stephen went on to arrange the murder of his wife (Photo: Your Tribute) -

(Photos by Tayfun Coskun/Anadolu; KanawatTH / Getty Images) -

(Photo by PETER PARKS/AFP via Getty Images) -

Photo: Godong/Universal Images Group via Getty Images