In case you were born in the 90s and don’t remember the infamous AIG bonus controversy of March 2009, it was a bizarre moment in our nation’s history when it seemed like everyone in America was angry about the same thing. And that particular thing was the crux of the “problem”—a microcosm of everything else that had gone wrong with Western civilization. Today, thanks to a lawsuit being argued in Washington, we now know how comprehensively we were duped.

AIG is an insurance company that sold credit-default swaps—insurance policies on the default risk of companies, countries, and other issuers of bonds. Some of those bonds were amalgamations of agglomerations of very dubious mortgages, which is in part why AIG ended up famously needing a massive federal bailout in autumn 2008. A few months later, someone in Washington noticed a provision in the bailout legislation that ensured retention bonuses for certain AIG employees, $165 million of which were being paid out to employees of the financial products division. Within days, various legislators had subpoenaed the company for the names and addresses of the bonus recipients. They introduced legislation levying a 90 percent tax on any bonuses that were not returned to the government; convened numerous congressional hearings in the ostensible attempt to hold someone accountable for this treasonous waste of taxpayer dollars; and deluged the 24-hour news cycle with inflammatory sound bites advising bonus recipients to resign, return the money, or kill themselves.

Videos by VICE

Reading news coverage of all this five and a half years later is kind of like reading old infatuation-era emails with a much older ex-boyfriend you never think about—but who in hindsight was kind of a pedophile. It goes without saying you will never again be that young or trusting, your senses never again so alive as they were in those months after the election of 2008, when it seemed as though our elected officials had somehow finally been moved by unprecedented events to switch their respective moral compasses off airplane mode and tax the rich. But it’s hard not to feel a little gross for having personally joined the outrage orgy—especially given the revelations of the lawsuit against the government brought by former AIG CEO Hank Greenberg, a cranky old rich guy Tim Geithner definitely figured would be dead by now.

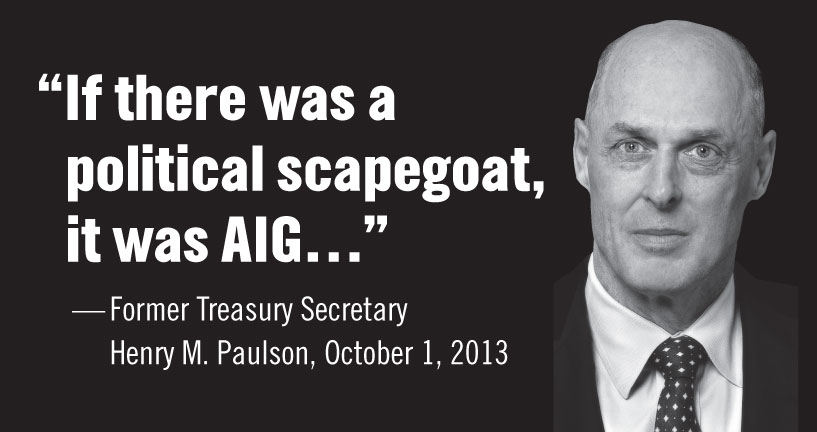

At the time we were told that it was the “greatest corporate failure in American history”—hat tip to Senator Richard Shelby—because politicians needed to cover up for the actual perpetrators of the crisis. They had us believe that AIG’s “rogue” financial products unit was the assassin of the economy, because they were conveniently placed and relatively unsympathetic bit players who happened to be completely removed from the more sinister machinations of the subprime racketeers. And in stark contrast to the narratives promulgated by former Treasury secretaries Tim Geithner and Henry Paulson and by appointed media mouthpieces like Andrew Ross Sorkin—whose crisis chronicle Too Big To Fail portrays the AIG bailout as the thoughtless design of a group of bankers Geithner summoned to the New York Federal Reserve Bank and exhorted to “Work harder, get smarter!”—the truth is that it was all very deliberate and intentional. Because, as the Fed and Treasury lawyers were acknowledging among themselves at the time, the AIG “bailout” appears to be by far the most illegal thing they did.

Here’s how Greenberg’s complaint chronicles his company’s assassination: On September 16, 2008, Geithner called Bob Willumstad, who had been the CEO of the company for all of three months, and told him he was about to send him the term sheet for an emergency line of credit, that he wasn’t going to like the terms, and that that was OK, because they were firing him anyway—replacing him with someone they could persuade to take the job. (Naturally, that someone, Ed Liddy, would turn out to be a former Goldman Sachs board member.) But the Fed apparently hadn’t gotten around to drafting a term sheet, so instead it furnished AIG’s outside counsel, a ubiquitous crisis figure named H. Rodgin Cohen, with two pages of incoherent bullet points Willumstad later said “might have been put together by my grandchildren.” Cohen instructed Willumstad to sign a single page with a line for his signature and the date, and nothing attached. He faxed it over to the Fed.

For the next week the AIG board labored under the delusion that they were negotiating a deal with the government—even filing a notice with the SEC on September 18 announcing their intention to hold a shareholder meeting to vote on the terms of the deal “as soon as practicable.”

Meanwhile, Fed lawyers were exchanging emails about how they were going to legally cover their asses to avoid any such vote, since there was decisively no provision in the Fed charter allowing it to seize control of private institutions. Finally, Thomas Baxter, the general counsel of the New York Fed, decided it would be OK if some of them set up an independent trust, overruling the objections of his titular superiors because, he explained in an email on September 21, the “concern that there will be a shareholder action.”

Cohen presented the government’s terms to the board that evening. It would extend to AIG an $85 billion line of credit at an interest rate of 14.5 percent, in exchange for $85 billion in collateral and 79.9 percent of the company’s shares. He would also no longer countenance AIG filing for bankruptcy under the “business judgment rule”—leaving the directors open to litigation if they voted to file. Which is when they realized, as one director put it, that “the government stole at gunpoint 80 percent of the company.”

Once in control, the government went about engineering AIG’s blitzkrieg self-destruction. The 14.5 percent interest rate was a death sentence in itself—the other 407 institutions that borrowed from the Fed during the crisis paid an average of less than 2 percent. But then the Fed commanded its puppet CEO to immediately buy back some $62 billion of mystery-meat mortgage “products” from a consortium of megabanks (but especially Goldman, which controlled $22 billion in mortgage credit-default swaps) at 100 percent of their face value. To put this in perspective, banks that purchased credit protection from insurers other than AIG ended up getting as little as 13 cents on the dollar out of the ensuring bankruptcies. If AIG had been allowed to file, it might have fared even worse than that, because in many cases the mystery meat it received in this deal was far more diseased than the crap it had actually insured.

In spite of all this, AIG ultimately returned to profitability. In fact, the relative health of its business may have fucked it harder than all those credit-default swaps—as one of the last institutions to run out of cash, it was also one of the last to start seeking a lifeline from foreign wealth funds. Once it did, the China Investment Corporation, the Government of Singapore Investment Corporation, and a consortium of Arabs who got Hillary Clinton to lobby their case all approached Paulson with serious offers. All were rebuffed. On September 26, China Inc. made an explicit $50 billion offer for four subsidiaries. It took ten days for Paulson to even bother calling back to officially blow them off.

Given all the blatantly illegal actions the government took to commandeer control of AIG, the bonus controversy looks almost like a cheap ploy to give the appearance that the Treasury and Fed felt somehow bound by the law in their dealings with the company. At the same time, as AIG executives’ houses became destinations for populist rage tourism, the uproar served to further intimidate anyone at the company who might have questioned the government’s handling of the situation.

Former US Treasury Secretary Timothy Geithner testified on a class-action lawsuit brought against the US government by shareholders of AIG. Photo by Win McNamee/Getty Images

The crisis was too big for any one institution to take the fall, of course. A week after the AIG takeover, rumors began to circulate that Wachovia was suffering a silent run of high-net-worth depositors, and the requisite authorities began recruiting potential rescuers to acquire the bank. In the end only one came forward, and the term sheet was harsh. Citigroup would agree to “save” Wachovia at a price of $1 a share, CEO Vikram Pandit decided, if and only if the government agreed to guarantee $312 billion worth of the bank’s assets—a move that would require the Federal Deposit Insurance Corporation to invoke a rarely used “systemic risk” clause in its charter.

But then Wells Fargo decided that Wachovia was worth $7 a share, with no government subsidies whatsoever, and made a counteroffer—incurring the wrath of Geithner, who recalled being “livid” at the news: “The United States government made a commitment,” he said. “We can’t act like we’re a banana republic!”

Geithner wanted Citigroup to “save” Wachovia because Citi had hundreds of billions of dollars of worthless mortgages and mortgage-based products on its books—close to a trillion dollars in uninsured foreign deposits that could evaporate at any moment. It also had a 12-figure line of credit with the Fed and the Federal Home Loan Bank and literally thousands of lobbyists, publicists, emissaries, and miscellaneous fixers—from former chairman Bob Rubin to Obama crisis headhunter Michael Froman, who simultaneously led a private-equity division at Citi and was in the president elect’s transition team during the fall of 2008—on its payroll. It desperately needed Wachovia’s massive deposit base to make it through the month, and it had the clout to make that happen. The day after Wells made its competing bid, one of Citi’s lobbyists slipped into the second draft of TARP legislation a line promising “exclusivity” to institutions recruited to rescue failing banks. The bill passed that evening, and the bank used the statute to get a judge to block the deal the next day.

With the help of celebrity lawyer David Boies, Wachovia and Wells ultimately prevailed, in part because the judge Citi persuaded to issue the restraining order had been a New York state judge and TARP was a federal statute. A week later, Citi got the first of three extra bailouts, in the form of one of the Treasury Department’s “mandatory” capital injections, in an episode that later led FDIC chairman Sheila Bair to wonder whether the entire production was simply an elaborate propaganda campaign to bail out Citigroup with minimal public embarrassment.

“How much of the decision making was being driven through the prism of the special needs of that one, politically connected institution?” Bair asked later. “Were we throwing trillions of dollars at all of the banks to camouflage its problems? Were the others really in danger of failing? Or were we just softening the damage to their bottom lines through cheap capital and debt guarantees?”

If there is one person who is now positioned to tell us what the point of all this shameless flimflamming was, it is Boies, who is now arguing Hank Greenberg’s case against the government. But while his meticulous reconstruction of events makes an irrefutable case that Geithner et al. acted intentionally, it makes no attempt to divine what their intentions ultimately were. If they were focused on saving Citigroup at any cost, then a $22 billion windfall for Goldman Sachs might have been one of those costs, but who knows. In the end it was all grotesquely profitable for Wall Street, just as the outcome of the Iraq War was great for war profiteers and the passage of time is generally great for the wealthy. But given how little popular opinion matters to the people who concoct these schemes, what warranted the elaborate disinformation campaign? In the end I think they just like fucking with us.

Follow Moe Tkacik on Twitter.