Ken Williams wants you to know Sierra On-Line was murdered.

In a new, self-published autobiography, Williams also says he doesn’t want you to remember the company the way you do. Williams founded Sierra as a telecommunications consultancy in 1979, when he was twenty-five; the company was the body to which his wife Roberta gave breath. Her Mystery House and King’s Quest, interactive stories of murder and fairy-tale chivalry, set a course for Sierra through the rest of the twentieth century as the leading developer of adventure games. King’s Quest begat Leisure Suit Larry; an adults-only joke book by and for boomer dads; Space Quest, a goofy, comic saunter through pop sci-fi, and for those who could not sanction such buffoonery, the fastidious cop procedural Police Quest. The psychosexual horror of Gabriel Knight and Phantasmagoria; the pun-laden cultural exchange of Quest for Glory: novelists have made careers writing about families with less personality than the Sierra product line.

Videos by VICE

Williams wasn’t a game designer, but a visionary who saw the company always moving forward, leading the market with other genres, other software, online worlds connecting every kind of person. That Sierra is instead remembered, basically entirely, for these 2D adventure games from the eighties and nineties is, he says, because the company was killed.

Williams has compared the end of Sierra to watching his child be tortured to death, but does not, in his book, offer a culprit, and has no real animosity for the most obvious candidate. Why is that? I spoke to Williams, and many others, to understand: if Sierra On-Line was murdered, why does Ken Williams seem to like the man who did it?

The Strength of the Chain

Roberta Williams remembers it was Paris. In the lobby of Le Bristol, before dinner with Sierra’s board of directors. It was the early 1990s. Sierra had gone public, and was fueling growth and share prices with aggressive acquisitions and early adoption of technologies like sound cards and compact discs that translated into lavish on-screen production value. Roberta’s vision as much as her husband’s had brought Sierra to this point; she was established not just as a creative leader in game design but a powerbroker in a public tech company making about a hundred million a year, with an international salesforce and a board that took meetings at luxury hotels abroad.

Maybe that was why Walter Forbes came through the hotel lobby in jogging clothes and asked Roberta, can I talk to you alone?

Forbes, who sat on Sierra’s board, was a greying, bushy-browed Harvard MBA and venture capitalist whose current gig was a company selling consumers complicated access to negotiated discounts at a variety of hospitality and shopping brands. The business was called Comp-U-Card, or CUC. (Time obviously has been unkind to the acronym.) Forbes had bought a seat on CUC’s board with a capital investment, then used the position to oust the founder.

Forbes led Roberta to a quiet area of the lobby. He had two things to say. One, that he was on his way up to take a shower before dinner. Second, a question. “Have you and Ken ever thought about selling Sierra?”

Sierra was a high-profile public company, so it wasn’t as though Roberta never expected the question. Just not out of the blue, from a CEO in jogging gear whose business model even Ken didn’t fully understand. And why was Forbes asking her, she wondered, without Ken there?

“No,” she said, “we’re not interested.”

“But if you ever were,” he said, “what sort of price would you be looking at?”

Or had he pulled her aside because Ken wasn’t there? Because Ken was the CEO and Roberta the wife, the dreamer of castles and dragons at the kitchen table, whom Steven Levy described in his book Hackers as “a demure, passive girl” so shy she “could hardly make a phone call”? Even while it was happening, Roberta suspected Forbes was looking for the weak link. Who’d blurt out something important, something she shouldn’t.

Roberta was not the weak link.

“A lot,” she said.

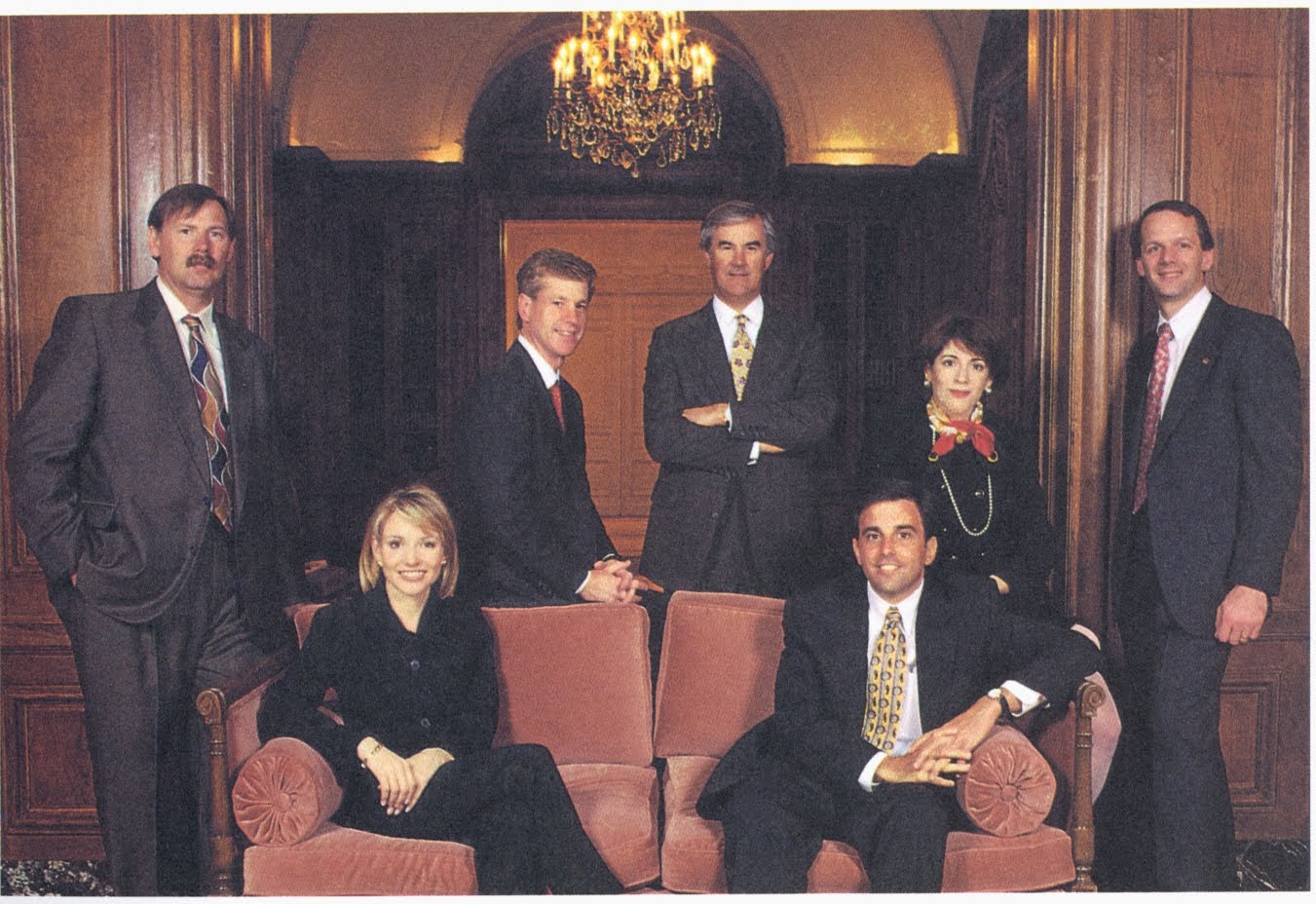

The Businessmen

“I often ask myself if I could have known that Walter Forbes was a crook,” writes Ken Williams.

Williams is a forthright, burly programmer who’s had the same Tom Selleck mustache for forty years and used to be chastised by the readers of his company magazine for never smiling in photographs. As a child, his family fled rural Kentucky and the legacy of a grandfather suspected of bootlegging and murder, for the opportunity of California; Joan Didion’s dreamers of the golden dream.

Williams’ dreams were uncomplicated. He wanted to be rich. “I wanted to live a different life than the one I grew up in,” he writes. “I read books about business executives who owned yachts and jets, and who hung out with beautiful models in fancy mansions.” Roberta was a beautiful California girl who lived “in the fancy side of town, in a pool”; on a double date, Ken downed a beer to show her he could piss farther than his friend. The simplistic plots of Roberta’s early King’s Quests more or less mapped to Williams’ ambitions. Get the power. Get the girl.

He had programming acumen and unabashed salesmanship. “I was a selling machine. I loved selling and I especially loved making money. I claimed every sales award and couldn’t stop selling,” he writes about his college paper route.

In Sierra lore, he’s famous for hacking the late-‘70s Apple II to render black-and-white line art for Roberta’s Mystery House. The work was not perfect, it had glitches—which Williams exploited to make the computer produce color graphics. He loved pushing the boundaries of technology, not just for its own sake but for the competitive advantage it could give his company.

By 1990, Sierra had established the Sierra Network, a proprietary social network with multiplayer games; they envisioned, essentially, the breadth of Second Life with the mainstream appeal and brand integration of Fortnite, but running on modems and servers housed in a local Wild West-themed restaurant. In Williams’ mind, the competition was never adventure game developers like LucasArts and Broderbund, but Microsoft and Disney.

By his late thirties, the backwoods of Kentucky were in the rear view. Williams had everything he’d ever wanted. On February 2, 1996, Walter Forbes surprised him with an offer for just a little bit more.

Forbes was recommended to Williams by another board member, a fellow venture capitalist. Williams was approached by his first venture capitalist in 1982, when few people, himself included, quite understood what one was. “[But] she was a good salesman,” he writes, “and I was always open to new ideas.” A million dollars in exchange for 20% of the company seemed too good to be true, but Williams figured that such investment was necessary to Sierra’s evolution into a grown-up business. Once he’d put one venture capitalist on the board, they multiplied like moneyed rabbits, culminating in the arrival of Forbes.

As a board member, Forbes advocated to grow Sierra by acquiring other software companies. It had paid off. In the financial year about to end, Sierra would declare an increase in revenues to $158 million with a net income of $17.8 million, up from a $7.9 million loss two years prior. But that was nothing to CUC, which in its last financial year had pulled in $1.4 billion in revenue. From coupons.

Forbes drew Williams aside after a board meeting in Bellevue, Washington, and said CUC wanted in on software. Would Sierra consent to be acquired for, say, a billion dollars?

Roberta had never warmed to Forbes, but he was Ken’s kind of guy: a flashy, charismatic and well-connected salesman who flew private jets, socialized with the likes of Bill Gates, made sweeping predictions about the online future, and even already had an internet retailer, NetMarket, in his pocket.

Forbes wanted CUC to enter and dominate the software market in one stroke, by acquiring not just Sierra, but LucasArts, Broderbund, the educational software maker Davidson and its subsidiary Blizzard Entertainment. King’s Quest, Leisure Suit Larry, Monkey Island, Myst, Prince of Persia, Carmen Sandiego, Math Blaster and WarCraft on the same balance sheet. (And, by November, Williams would have the rights to Half-Life.) “He had come to Ken with the idea that this is kind of a done deal,” Roberta says, “and if you don’t do it, you’re really stupid, because this is going to be big. Your stockholders and your board would not like it; it’s almost like you have to do it.”

On February 12, Williams negotiated with Forbes’ team an offer of a tax-free stock exchange, in which each share of Sierra stock would be exchanged for 1.225 shares of CUC stock; with CUC’s stock valued at approximately $48 per share, this represented a premium of about 69% over Sierra’s actual trading price. As offers go, it was an extremely generous one to Sierra’s shareholders and employees—who generally held some amount of Sierra stock as part of their compensation package—and Williams and Roberta, whose 9% stake in the company would increase in value to $64.8 million. (In CUC stock.) Forbes boasted to Williams that CUC had “a long history” of “beating Wall Street expectations”; that its stock “consistently outperformed the market.”

It was an offer Williams couldn’t refuse; at least not back in 1996, when he did not know the reason CUC consistently outperformed the market and could offer a billion dollars for Sierra was because it made numbers up.

A Coupon for Magic Beans

Everyone told Williams not to do it.

“They hated it,” he remembers of the board’s reaction. “Because we were on a roll. We were unstoppable at that point.” If it was an acquisition where Sierra would retain control, that’d be one thing, but a merger with three major developers under a parent with no software experience? “It was beyond bad inside Sierra.”

“I didn’t want to sell it,” says Mike Brochu, a Texan who Williams hired in 1994 out of the finance world as Sierra’s chief financial officer, and who was promoted within a year to president and chief operating officer. A self-described hired gun, he was brought in to tighten up Sierra’s professional discipline and stuck around longer than intended after developing an unexpected affection for the business of game development and Williams personally. These days, Brochu talks about Sierra like a gunslinger about that ranch where he could have settled down.

“I pleaded with him,” says Jerry Bowerman, an MBA and investment banker who Williams had hired for a kind of apprentice role, and later progressed to vice president of product development. “It made my hair stand up on the back of my neck. Here’s this company that sells a coupon, and it’s now going to own two to three entertainment software companies?”

Brochu and Bowerman were Williams’ lieutenants (“The three musketeers,” Bowerman says) and intimately involved in the crisis talks that followed Forbes’ offer, conducted in secret to avoid leaks that might impact the stock price.

The other major voice in the room was Roberta. “I was not a fan of it. When Walter asked me did we ever think of selling the company and I said no, I meant it.” Like Brochu, she enjoyed what she was doing—at what other company and in what other time would a designer best known for fairy tale adventures be given millions of dollars, creative control, a brand new film studio with a live actors and full marketing support to make a violent and sexual Grand Guignol with puzzles? Moreover, she didn’t really trust Forbes. “I always had a little bit of intuition about Walter. Not that he was a crook or anything like that, just…. take him with a grain of salt.”

Roberta had tremendous influence on Ken’s decision-making, who particularly valued her read of people and character. “I can’t tell you how many times in a meeting [where] we’re trying to get Ken to make a decision, he would say ‘I need to sleep on it,’” says Bowerman. “That, I came to learn was code for, ‘I need to go home and talk it over with Roberta.’” Around 1984, the venture capitalists on Sierra’s board pushed a merger with an educational developer, Spinnaker, to which Roberta was opposed and Williams amenable. Roberta blew up the deal by arriving late to a meeting between Sierra and Spinnaker and declaring, “These guys are a joke.”

It wasn’t just Roberta who had his ear. Ken advertised himself as a leader open to persuasion. “Ken would look you straight in the eye and say, ‘Here’s what I think, but I can be convinced otherwise,’” says Brochu. “And he meant it. If you had a better argument or a better way or a different idea, he would listen. It wasn’t his way or the highway.” When designer Jane Jensen pitched Williams her steamy voodoo mystery Gabriel Knight, he said, “Nobody wants to play something dark and depressing on the computer,” but trusted her enough to greenlight it. In 1996, in spite of a personal distaste for violent shooters, he saw the potential in, and agreed to publish, Half-Life.

But Bowerman—who says Williams viewed him as a protégé; that Williams once said “I was like the son he never had, even though he had two sons”—struggled to make the case against CUC. “Nobody beats Wall Street estimates exactly by a penny 24 quarters in a row,” he remembers warning Williams of CUC. “That’s categorically impossible. Does not happen.”

Williams took the deal.

Shareholder Value Theory

As he sees it, he didn’t have a choice.

“Management has an obligation to look at the bigger picture and say, is this good for shareholders? At the time, I honestly thought it was.” The money was one thing, but CUC would theoretically provide the financial stability and resources for Sierra to continue its growth.

“You’d have to convince your shareholders that you can do a much better job if they didn’t sell, and they’re sitting on a pretty decent premium to sell. They invested in you for a reason and they want to make their money,” says Brochu, who saw the math, and did not fight the deal too hard.

Roberta resisted. “But I was made to realize, and it was true,” she says, “that we kind of had to. The deal was so put-together and at the time Walter was very well thought of on Wall Street. CUC was a big deal and Walter was almost thought of as a god. I don’t know why, but he was.” And if a god offers you a billion dollar deal and you say no, “you could theoretically be sued by your shareholders.”

At least, you’d need an argument that the company would be better off not to sell. And Ken was tired.

“It was hard for Ken to try to really run and grow the company as it could be,” says Roberta. “He was experiencing a lot of stress and just didn’t quite know what to do about that. So the idea for Ken of merging the company or selling was appealing to him just for that reason. I, on the other hand, was having a great time.”

Williams’ natural competitiveness and excitement to do new things with computers made him a good fit to lead a public company that fed on growth and expansion, but maybe in the same way that a lightbulb is a good fit to lead electricity. It would never have been enough, not for Williams nor the board, for Sierra to have levelled out as, say, a boutique producer of high-quality adventure games. Sierra needed to stake out territory on the internet even before modems were common in households. It didn’t have a footprint in Europe, so it had to buy a French developer. It didn’t make racing games, so it had to buy a company that did. Repeat with image editing software, landscape design software, golf games, submarine games. (Who looks around and says “I simply must own a company that makes submarine games”?)

A sale, to a massive and prosperous company like CUC, would not only relieve Williams of the headaches of investors and quarterly reports but guarantee the livelihoods of his thousand employees and their families. Williams had nearly lost it all years before: in 1982, at the urging of Sierra’s first set of venture capitalists, he agreed to pivot from computer software to video game cartridges for, e.g., the Atari; an industry that brutally crashed months later. “He had to mortgage his house to make payroll and still had to lay off the majority of the team,” says Bowerman. “It profoundly scarred Ken and Roberta. They took the responsibility as board members and Ken as CEO like ten times more seriously after that.”

It didn’t necessarily matter that CUC was not the buyer Williams ever would have expected. “The chance to be part of a $2 billion company that I thought was going places was exciting,” he says. “If all that happened was I got stuck running Sierra, that would be perfectly fun. Then I could actually get closer to the product. Or if I flipped over and ran NetMarket and was going into shopping, that could be fun. And if the worst happened and I was flushed out entirely, and all I had was a lot of money, that would be fun, too.” As early as 1980, Williams was dreaming of the kind of success that would allow him and Roberta to retire at thirty. “As fun as developing games are, when you’ve done it for, at that point, almost 18 years, that gets a little old.”

Anyway, he had no choice. “He has a fiduciary responsibility, and the board has a fiduciary responsibility, to take the offer seriously,” says Bowerman. “All that’s true. What they never did do was, like, hire an investment bank to say, is this actually a fair offer?”

Had they done so, they’d have found only confirmation that CUC was a healthy, hungry start-up well-liked by Wall Street. While CUC wouldn’t let Sierra see its internal financial data, it did have assurances from the Big Four accounting firm Ernst & Young that the books were not just in order but reflected a company so fabulously wealthy that it could pay for Sierra not with cash, but pieces of itself.

Still. Roberta had a vibe.

Wet Ink

On February 20, 1996, less than three weeks after Forbes floated the idea, CUC announced that Sierra and Davidson were to be acquired for $1.06 and $1.14 billion respectively in CUC stock. Broderbund and LucasArts were out. “We just weren’t interested at their price, nor in being acquired for stock in their company,” says Broderbund founder Doug Carlston. “It was a short meeting.”

“This acquisition represents an opportunity for Sierra to capitalise on what we already do extremely well: develop the highest-quality interactive entertainment, education and productivity titles in the industry,” Williams said in a press release. “CUC brings potentially 40 million new consumers in the interactive marketplace. We’re looking forward to growing this business with CUC and reaching every one of those customers.”

CUC’s stock fell 17 percent. Sierra and Davidson’s stock, after an initial surge, followed it down.

Forbes assured the markets that all would be well. “Our goal is to be the largest content provider in the electronic marketplace,” he said. “There’s a new age coming—and if you believe in that then you have to like the moves we’re making.” When an analyst who downgraded CUC’s stock questioned the wisdom of a $2 billion acquisition as CUC’s first step into the software industry, Forbes defended the move as the literally only way CUC could do business. “We’re owners. We don’t like joint ventures…. we don’t want to share any of this.” Not only would the acquisition of Sierra and Davidson allow CUC to compete with Microsoft and Disney in entertainment and edutainment, Forbes said, but the developers could also work on “a more attractive interface” for the CUC website; so, there were lots of ways in which CUC would benefit.

Reaction inside Sierra—where the news broke via an email from Williams shortly in advance of the press release—was puzzled. “I don’t think it’s inaccurate to say that none of us had any idea what CUC International was,” says a senior artist with Sierra at the time.

Craig Alexander, then the general manager of Sierra’s Oakhurst studio, agrees. “It seemed odd because they weren’t a media company. We always assumed we’d be bought by a large media concern or Hollywood studio or a technology company.”

It scared Al Lowe, the creator of Leisure Suit Larry. “When CUC took over, [they said] ‘We love the company. That’s why we bought it.’ Translated into English, that means, ‘We’re going to change everything.’”

Bob Davidson, the chief executive officer of Davidson and Associates, acknowledged that similar acquisitions had failed in the past, but one thing about CUC gave him confidence. He had visited CUC’s headquarters in Stamford, Connecticut, and had been “amazed” to find that despite CUC reporting annual sales of over a billion dollars, there were just twenty people in the office. What work ethic; what an entrepreneurial culture.

Point of No Return

There’s a problem, Mike Brochu told Williams. Although the acquisition had been announced, the deal would not close until July, and apparently Davidson’s sales team was advising Walmart’s buyers to hold off on ordering Sierra games. Soon, Davidson would be taking over and selling Sierra products at a discount.

Williams knew of no decision about consolidating the sales teams. He’d been promised by Forbes that Sierra and Davidson would operate independently, at least at first. If Davidson proved to have the superior sales force, then fine, he’d happily use them instead, but at least let him make the argument. He’d personally brokered a new power structure with Forbes specifically so he’d have that opportunity: CUC’s combined software division would be run by a tripartite Office of the President consisting of Ken, Bob Davidson, and a CUC executive, Chris McLeod.

Forbes said he didn’t know what the Davidson rep was talking about, but acknowledged that Williams was unhappy. The board was urging Williams to exercise a clause in the acquisition agreement that allowed Sierra to terminate the deal if, before July, CUC’s average stock price fell below $29. It had.

Williams says now, and said to Forbes then, that he was ready to walk away. Forbes assured him the stock price would rally; that he himself was out there on Wall Street, pounding the pavement, working investors. What if, Forbes said, he added Brochu to the software board, and made Williams a CUC vice-chairman, and put him on the CUC board? And remember NetMarket, Forbes told Williams: that’s the future.

“Ken was so enamored with Walter, and Walter was such a smooth talker,” says Bowerman. “Ken [is] singularly motivated by money, and [he] saw Walter flying in these private jets, buying expensive wine, staying in a nice hotel…. [he became] a fan.”

“Ken is a very nice person,” says Roberta. “You might say he’s nicer than I am. And he is very trusting. He’s actually too trusting to be a CEO of a company, in some ways. He doesn’t ever like to see a bad side of anybody. During our whole run of Sierra, from starting it to selling it, I’ve occasionally said to Ken, ‘You know that person? I really have to question that person, and whether we should work with them.’ And he would always be a little offended that I would think that way about someone. He would. He tended to be trustful.”i

Williams says the issue is he always wanted to be the nice guy. As a boss, in some ways, that helped him: he encouraged challenge and critique and didn’t take either personally. The flip side was he “had a hard time, and still [does], saying things that upset people.” For layoffs, or mandating overtime on holiday weekends, he relied upon Brochu and Bowerman. “If I was the one who had to sit across the table and give them bad news, that would be much tougher. It’s nice to have some layers between you and the damage you cause, I guess I’d say.”

If Williams killed the deal, Forbes would be pissed, but if he trusted that Forbes was right, that he could resuscitate the stock price—well, then, everyone would win. And that was what happened. CUC’s stock recovered, even surpassing its earlier levels. The deal to acquire Sierra closed on July 24, 1996. Everyone was rich and Williams was the nice guy.

Bowerman remembers a Paris dinner in celebration of the closing, where Forbes ordered a $5,000 bottle of wine, and soothed the startled table with a promise he would pay for it personally. “I find out after the fact, digging around in the accounting systems, that he’d expensed it,” Bowerman says. “So he was just a liar. Just a very fat liar.”

Sleight of Hand

Henry Silverman thought Walter Forbes was a clown.

A no-bullshit, numbers-driven corporate raider (“the king of franchising,” as per Fortune), Silverman was not as enamored of Forbes’s visionary swagger as some, but he was somewhat persuaded by CUC’s earnings. “What turns him on is watching the stock price go up,” said Silverman’s long-time colleague Steve Holmes.

Not enough to sell his company—HFS, an owner and licensor of hotel, real estate and car rental brands like Days Inn, Ramada and Avis—when Forbes asked, but he did agree to merge their businesses. In December 1997, just over a year after the Sierra deal closed, CUC and HFS became Cendant Corporation, the 72nd most valuable company in the United States, one place ahead of Merrill Lynch. Forbes envisioned it as the “the premier consumer services company,” through which, e.g., any hotel guest, homebuyer or car renter at HFS’ brands could be enrolled in CUC’s marketing databases.

As part of the deal, Silverman would serve as Cendant’s chief executive and Forbes as chairman, and switch jobs in 2000. Forbes had preserved CUC’s “financial-reporting autonomy” by keeping in post CUC’s chief financial officer Cosmo Corigliano and corporate controller Anne Pember. All CUC’s financial reporting would be filtered through those two; neither Silverman nor his team would have direct access to the data. Even during merger negotiations, CUC had refused to share its private financials with HFS, out of supposed concern that HFS might then decide to purchase a competitor instead.

It all seemed strange to Silverman. “[But] every time I was nervous, they would show up with another quarter of spectacular earnings,” he said. “This business was producing 20% to 30% growth in a company where nobody worked…. this could be a gold mine.”

In January, a month after the merger, Silverman asked Corigliano and CUC president Kirk Shelton to start furnishing him with daily cash-flow figures. That was how Silverman operated: hands on, needed the numbers. Corigliano and Shelton said they were not really used to producing reports like that. Silverman said to do it anyway.

“They were like children playing at business,” complained Cendant’s general counsel James Buckman; to him, to Silverman and the HFS guys, CUC’s comparatively relaxed corporate culture and Forbes’ tendencies to brainstorm in bare feet, golf every other afternoon and take two months’ vacation each year was obnoxious and unserious. CUC, however, took it as a badge of honor: despite growing into a billion-dollar business, they’d never lost the entrepreneurial spirit of their start-up youth.

By March, Corigliano and Shelton hadn’t sent the figures, nor provided any information for Cendant’s first annual report to the SEC. With the filing deadline for the latter fast approaching, Forbes yielded CUC’s autonomy and let an antsy Silverman put his own team on the project.

Looking at CUC’s books was to see the thing behind the dumpster in Mulholland Drive. In its 1997 and 1998 budgets, CUC had put aside $165 million for one-off merger costs, but had not spent it. Now, they were proposing to declare that money as new income. Cendant’s chief accounting officer remembers Kirk Shelton saying, “We want you to help us figure out how to creatively do this.”

Shelton denies making that comment, and in any event, the CUC executive did not try to induct Silverman’s people into the scheme. Instead, both CUC and Ernst & Young assured Silverman that all suspicious-looking transfers—there were more, going back a year—were easily explained and of no concern. Silverman had Forbes, Shelton and Corigliano sign affidavits to that effect, and submitted the whole package to the SEC.

Silverman was furious, and while Forbes denied all knowledge—he was a big-picture visionary, he reminded Silverman, who “never ran the shop”—he agreed to hash it out after returning from his Hawaiian vacation.

On April 1, Silverman met with Forbes and said it would be appropriate for the latter to step down. Forbes agreed, then after the meeting disregarded the suggestion. “I didn’t take it very seriously.” By April 9, however, Kirk Shelton, Cosmo Corigliano and Anne Pember had resigned. “Cosmo was well-thought [of],” said one analyst. “People were surprised and took it as something was going on.”

That day, at the request of the New York Stock Exchange, Cendant agreed to a short halt on trading. Silverman got on a conference call with analysts to assure them that the executive departures were no harbinger of anything dramatic, merely growing pains. Anyway, he said, just look at the earnings for this last year. Spectacular.

As soon as he hung up, he got a call from Cendant’s chief financial officer, who said actually, it is a lot worse than we thought.

The New Boss

There’s a secret of business that Ken Williams says he learned from Bill Gates. Ask an executive or a prospective hire for their golf handicap, and if they give an answer, write that person off. Serious executives don’t play golf. Williams kept that in mind at his first CUC board meeting in New York, late 1996. The board began with a robust round of golf talk, while Williams sat silently and strategically for the opportunity to demonstrate that he was a real businessman.

“How’s business?” someone finally asked Walter Forbes, after an hour.

“It’s good,” Forbes said, and ended the meeting.

Williams left in shock. It was one thing not to understand CUC’s business model from the outside, but how could he be there in the board meeting and still not really know what the company did? “They were a joke,” says Jerry Bowerman. “The average board member was like 80 years old. They fell asleep during the meetings. It was something else.”

Another surprise: Williams had begun his career at CUC expecting to convene the first meeting of the conglomerate’s software board, with himself, Bob Davidson, Mike Brochu and Chris McLeod as equal partners. But there was no software board, and Bob Davidson was his boss.

Williams had been social, but not close, with Davidson, a former engineering and construction executive who ran his wife Jan’s educational software studio. “There was no fooling around,” with Davidson, says Mike Albanese, a veteran software producer at the company. “It was all sales, sales, sales, make the product, sell the product. In meetings, someone would complain that product development was a month behind and Bob’s response was ‘Sell what you have now.’” That was the kind of thing Williams would say, too, and Williams did think Davidson was a smart guy. He looked forward, or was at least clear-eyed, about working alongside Davidson through a transition period to merge their respective companies under CUC. “If it turned out that my CFO wasn’t the better CFO, and we had to swap to their CFO,” he says, “I’m not gonna cry about that.”

Instead, Davidson moved quickly and unilaterally to consolidate all CUC’s software units under his aegis, notwithstanding the power-sharing agreement Williams had negotiated with Forbes. Davidson was the chief executive officer of CUC Software: there was no software board. Brochu remembers Davidson saying Brochu worked for him. Brochu replied, “No, I don’t,” and walked out of Davidson’s office, never to return.

“There was a cultural clash,” says Brochu, “a rigidity to the way Bob wanted it. We said, no, we were pretty successful doing it the way we’ve been doing it, we’ll keep on keepin’ on. ‘No, you’ve got to do it this way.’ We weren’t compatible. He was way, way, way more buttoned up than we were.” Brochu remembers in the early meetings about consolidating staff, Davidson was particularly forceful that his team outperformed their Sierra counterparts. “I would always say, just because you say it real loud and real fast doesn’t make it true. But he could make it sound true. Way better, to be fair, way better than Ken could.” Brochu used to play poker with Williams: he remembers him as a player who’d consistently bet when he had a good hand and never when he didn’t.

Williams went over Davidson’s head to Walter Forbes’ deputy Kirk Shelton. “Below is my analysis of the three options facing you,” he wrote Shelton in an email. Those options were to fire Davidson, fire Williams, or—Williams’ preference—allow Williams to operate Sierra as a semi-autonomous development studio with Davidson as publisher. “Bob dislikes this option,” Williams acknowledged, and indeed it came to nothing.

In a later email, Williams pitched Shelton “a radical thought,” whereby he would be made president and chief operating officer of CUC Software to Davidson’s chief executive. “I will report to Bob and everything else will report to me…. I have tremendous respect for Bob and would not ignore his good ideas. Hopefully, by now, you’ve figured out that I am a reasonable person to work with.” Whereas, he added, “I believe Bob has an ego problem.”

CUC was not unhappy to have Davidson in charge. “[Davidson] had a tight-running machine,” says Bowerman. “He also had Blizzard, which was the hidden crown jewel in the whole thing. [And] when you met with them, you walked away so impressed. Even though they weren’t selling a lot of software, their system processes, their discipline, how they approached market research and development… they were pretty buttoned-up and [Davidson] didn’t have a creative bone in his body, but if you took personalities and emotions out of it, they were running a better business than we were.”

Nonetheless, Shelton tried to appease Williams out of concern that his departure would inspire a mass exodus at Sierra. He tried to mediate. “What’s worked well for CUC is to have a small group of very good people and work very closely. I hope we can do the same for Software,” he wrote to Davidson and Williams in late 1996. “The key is making sure that you both are comfortable working together and have a clear understanding of what each needs…. Ken needs for his remaining organization not to feel subordinated to the Davidson organization. And if you can cooperate as peers, I think Sierra can retain its uniqueness and creativity, which I think are crucial.”

“Your e-mail suggests you may not have all the facts,” Davidson replied. “Both my employment contract and the consolidation memo indicate that I do have overall management responsibility for all the software business within CUC, including Sierra. There is simply no way we would have sold to CUC under any other circumstances. Jan and I and our board of directors were given absolute assurance that we would retain overall management control of all software units. It is unthinkable that CUC would default on its promise.”

Williams had asked Forbes for compromise. Davidson had asked for control. Forbes said yes to both. Each promise was worth about the same in that they proposed incompatible realities, with Forbes evincing little interest in which one manifested. Davidson won out because Williams thought he would be rewarded for being reasonable, and Davidson knew it didn’t have to work that way.

By the end of 1996, it was clear to Williams that he’d lost control of the company he founded. He left Sierra to run Forbes’ pet NetMarket project, expecting one day to return.

Crime Scene

A year and a half later, two CUC managers revealed to Cendant’s chief financial officer that they had been instructed by executives to inflate revenue through fabricated income and arbitrary adjustments “to meet Wall Street expectations,” and that this had been going on for years. One of the whistleblowers recalled being told by Anne Pember that it was too suspicious to declare fake income in excess of five million; much better to make it under three, and add a random number of pennies at the end.

On April 15, 1998, Cendant announced that the earnings it had declared for 1997 would need to be revised down by about $115 million. The next day, Cendant’s stock dropped from $36 to $19, erasing $14 billion from its market capitalization.

Forbes said he was shocked. As a visionary, he was naturally unaware of things that happened at this level. And are we sure, he said, that all this was not just made up by Henry Silverman to effect a coup?

An emergency meeting of the board, deadlocked by competing loyalties, took no action against either Forbes or Kirk Shelton. “It’s wrong to assume that I’m going anywhere,” Forbes told the New York Times, and to Silverman: “it appears that you are hell-bent on ‘bashing’ CUC.”

Cendant hired an accounting firm to look into the supposed fraud, and in July, investigators reported a pattern at CUC of “accounting errors made with an intent to deceive.” Over at least three years, CUC had declared half a billion dollars in revenue that, in fact, did not exist.

Palace Coup

Ed Heinbockel, Sierra’s former CFO, says Roberta Williams saw herself as the Steven Spielberg of gaming, and she was about as close as anyone. A star name and hit-maker whose each title manifested an incremental leap forward in production design—professional voice casts, CGI cinematics, Disneyesque animation and song—while iterating on standards of game design and accessibility.

“When I do a project, I wonder if there are any Roberta Williams games shipping at the same time,” Gabriel Knight’s Jane Jensen said in 1997. “Because, if there are, I know I am going to get the short end of the marketing budget.” At Williams’ Sierra, budgets were directly proportional to past sales figures, and when designers told Williams that they’d be able to do more with more, Williams replied, “It doesn’t work like that.”

“I absolutely played favorites,” he writes, “and the rules were simple. Ship a best-selling game and you are my favorite person. Ship a dog and you should start looking for work…. If someone needed my help or for me to go out on a limb on their behalf, favoritism counted.” If that’s a contradiction in Williams’ nice guy persona, it’s not a complicated one: he was the nicer guy to people who made him money. Quest for Glory’s Corey Cole freely compares Williams to Donald Trump.

Roberta felt keenly the constant expectation to up the ante. It wasn’t just her name and her games: King’s Quest was Sierra’s tentpole, and its fortunes had always corresponded to those of the company. By the sale to CUC in 1996, she had begun early work on the eighth King’s Quest, which would be Sierra’s first adventure in real-time 3D, with a camera moving behind the player character. “Classic adventure games were starting to feel a little bit dated,” she says, and she was eager to figure out how the old format could be translated to a full 3D environment.

The game, subtitled Mask of Eternity, was Roberta’s first under CUC and the first to bring her back into the office: she’d become accustomed to working from home and having development teams come to her, but this would be such a project she felt she needed to be in the office full-time. When she got there, and saw what the team were building, she didn’t recognize it. “I started looking at it and going, ‘What is this?’ I mean, experience points? They had completely redesigned the interface. It looked like an RPG. And [they] said, ‘Don’t worry about it. This is the future.’”

Roberta remembers her producer, Mark Seibert, suggesting that her formalist adventure game design could be expanded to include combat and bring King’s Quest more in line with RPGs like Blizzard’s Diablo. “I would say, this isn’t a role-playing game. This is an adventure game. It’s completely different,” she says. “But the argument the team would get back to me was, ‘Yeah, but role-playing games are in now. That’s the thing.’ And it’s true. They weren’t lying.”

Roberta would remove the more overt RPG aspects, only for them to be put back in, and her changes taken out. It was not, she acknowledges, a way to work, and her team agreed. “My team wasn’t listening to me,” she says. “They were kind of telling me that I could go home and they’d call me if they needed me. It was rude, frankly.”

“Mask of Eternity was definitely being pushed around by many forces,” says Mark Seibert. Ken Williams thinks it was about Davidson leveraging the King’s Quest brand into a more profitable direction; Seibert suggests it was an early indication of a larger marketing department, newly empowered under CUC, that was “not excited about internal development teams.”

At home, Roberta would tell Ken her game was being ruined. “I don’t want to say I cried, but I cried, you know. I’m not a person who does that. I’m really not a person who does that. I was very, very upset.” Ken says even in the old days, it was not uncommon for developers on Roberta’s teams to go over her head and complain to him. He’d confirm her authority as the project lead, and that’d be that. This time, first mired in conflict with Davidson and then out of software entirely, he couldn’t do anything.

Roberta, they suspected, was on the shit-list anyway: they believed CUC, and later Cendant, had intentionally stopped marketing the more controversial Sierra games, including her blank check Phantasmagoria. “Henry Silverman isn’t sure he wants to sell Phantasmagoria,” Williams remembers being told. During the development of Mask of Eternity, Cendant further alienated Roberta by sending her an unexplained royalty statement indicating that she owed Sierra money. “I had done a lot for Sierra,” she says. “I felt like they would just love it to pick me up and boot me out if they could.”

Cendant wanted Mask of Eternity out by Christmas, and as that deadline grew increasingly close and unachievable, Ken and Roberta took that moment to point out that, despite repeated requests on her part, she had not signed a contract, and would walk away and publicly disavow the game if she were not brought back into the fold with a meaningful role. Cendant acquiesced, in the last months of development, to let Roberta claw the game somewhat back to her original vision in the short time that remained.

“I signed my contract after it shipped,” Roberta says. ”I waited, because I didn’t trust them. They wanted it very, very badly, and I wanted them to basically, kiss my ass, a little bit. If that sounds arrogant, you know, I’m sorry.”

Golf, Anyone?

“I am as outraged as anyone,” said Walter Forbes on July 28, 1998, about revelations that $500 million of reported CUC revenue over the past three years had not existed. He would also face questions over hundreds of thousands in unexplained cash advances and corporate credit card bills.

“Sixty-one percent of your revenue was not there,” replied a Cendant vice-chairman at a board meeting. “You were the CEO. You had a responsibility to know.”

Although Cendant’s board could not muster the votes to fire Forbes, he left of his own accord, with $12.5 million in Cendant stock options. The value of those stocks had been slashed from a high of $41 per share to $10, but Forbes, having pocketed another $35 million in cash, would not have been overly concerned. He transferred all his property into his wife’s name and killed a few years developing and playing on golf courses until he, with Kirk Shelton, was charged with accounting and securities fraud.

Silverman, minus hair, weight, and $800 million of his net worth, was left reigning over a house of cards on fire.

“I’m consumed,” he said, “by blind rage.”

The Veil Lifts

In January 1997, Bob Davidson, weeks after successfully asserting that he and he alone ran CUC Software, quit the company. According to Kirk Shelton, in the days immediately prior, Davidson had sold off much of his CUC stock and presented an ultimatum: if CUC’s software units were not spun off as their own company with Davidson as CEO, he and Jan Davidson would leave. Forbes and Shelton replied that they hadn’t acquired Sierra and Davidson only to unacquire them months later. Davidson acknowledged this—it was an unlikely demand—and resigned. Strange moves at the time, but wise ones to make if you had any idea of what was coming.

Williams, in online shopping exile, expected Davidson’s departure to clear the path for his return. Instead, CUC appointed long-time executive Chris McLeod. “I thought it was a dumb move,” Williams says, “but my job was to try to make it successful, not to grumble about it. I was trying to be a good soldier.”

Williams spent 1997 planning how to make CUC’s NetMarket the online shopping destination, though he didn’t view this as a demotion. NetMarket was Forbes’ favorite child: his talked-up moonshot that would cement CUC’s dominion in the online future that was coming for everyone. Both Forbes and Williams saw how dramatically the internet would transform all business, and though Williams’ first attempt to capitalize on that with the Sierra Network had failed, here was another, grander chance. (Although NetMarket was not Forbes’ idea, but another acquisition.) Williams had been flattered to think that Sierra was acquired because while software was all well and good, it was really his experience with the internet that would make NetMarket change the world. “They let Ken believe that because of his business acumen, and because of what he’d done with Sierra and founding it, that he would be heir apparent to Walter,” says Bowerman.

In the summer, Forbes invited Williams to pitch his plan for NetMarket at a management retreat in Vail, Colorado, where he owned a golf course. “They shit all over it,” says Bowerman. Williams felt humiliated and ignored. “We said, ‘NetMarket’s the future, we just need a few million dollars,’” says Bowerman. “They lost it. We thought we were doing something really innovative—and we were—but we didn’t understand the bigger picture.”

That being, among other things, CUC was then courting a merger with Henry Silverman’s HFS, and probably wondering whether they could get away with telling them that they didn’t need to see the financials. “I was talking about investing and servers and building software,” says Williams, “and I think they were focused on the issues that ultimately sent them to jail.”

Kens left the Vail meeting and vented to Roberta over the phone. Forbes had treated him like a little boy. He wasn’t allowed to do anything.

Roberta hung up and went to bed. “This feeling of dread came over me,” she says. “I know this is gonna sound weird, but it’s true. I got up the next day, and I said to Ken, we have to sell our stock. I mean now.”

Closing Time

Jerry Bowerman thinks he was the only Sierra employee to cash out when the CUC stock was still trading at around $40 a share; he estimates he got millions out of the affair. Enough things had tipped him off: Davidson’s departure, CUC estimating for accounting purposes that the useful life of a game developer’s computer was seven to eight years, Forbes and his $5,000 wine.

“It’s a house of cards,” he told Williams. “Get out.”

Williams felt burned from the NetMarket pitch and Forbes’ misrepresentations about how things would work with Davidson, but he made a move only at Roberta’s urging. “I saw a lot of the lies during the purchase as them telling me what I wanted to hear, but Roberta is much more passionate than that,” he says. “Lie to her, that’s it, you’ve crossed the line.”

“I don’t like how we have no control anymore,” Roberta told Ken. “You and I don’t have any idea what’s going on. All of our net worth, all of our twenty years of running Sierra, is on the line. Something doesn’t feel right to me. I’m extremely uncomfortable having everything we’ve worked for under the control of these people.”

Ken, already inclined to resign, called his stockbroker and sold everything he could. Roberta advised friends to sell. “I probably shouldn’t have done that,” she says. “And they didn’t, because the stock was doing really well at the time, and supposedly still going to go up, up and up.”

Ken left CUC and Sierra on November 1, 1997. Roberta, her stock options almost all divested, stayed to finish out Mask of Eternity. One month later, CUC and HFS merged to form Cendant, and Henry Silverman told Kirk Shelton and Cosmo Corigliano he needed to see the books.

Fire Sale

It never did make much sense for CUC to acquire software companies. In August 1998, with Cendant bleeding, Henry Silverman saw no reason to keep them. “I think he took the attitude that he wished he had never heard of CUC and couldn’t get rid of all their stuff fast enough,” says Williams.

“We inherited the business,” a Cendant spokesman told the Los Angeles Times of the software units. “It’s not part of our core strategic business model.”

Wreckage

Bad news travels in all-staff emails within minutes of a press release. On April 15, 1998, employees at Sierra learned of CUC’s exaggerated accounting along with the rest of the world. Internally, anger and dread prevailed. For some, it was clarifying. “These little conversations stick out,” says Craig Alexander. “I remember CUC or Cendant management lecturing me and my leadership about why we couldn’t deliver revenue and earnings on a quarterly basis. They were all proud of the fact that they had been delivering to Wall Street expectations for the last four or five years. ‘How come you guys can’t do that?’”

Stock options had long been a major part of the Sierra compensation package, so most employees and former employees were affected by the overnight collapse in Cendant’s share price, and its continued fall. “I had a fair amount of my net worth at the time tied up in that stock,” says Mike Brochu. “Holy crap, it just plummeted to nothing.” Leslie Balfour, a writer and producer at Sierra until late 1997 saw her stock fall from $100,000 to $20,000. Al Lowe says he and his wife lost “the equivalent of a really nice home.”

Mike Albanese remembers colleagues from Davidson calling him in a panic. Just months before, they’d been telling him about something called “salary replacement,” whereby CUC was offering employee salary reductions in exchange for stock options. Albanese hadn’t taken that deal; in fact, he’d left Cendant and cashed out, really just in time. “Leaving Cendant was the best thing that ever happened to me in my life next to my wife and child.”

Less fortunate were the Sierra employees who’d borrowed on their stock options to buy houses, whose banks called in their loans when the stock fell and had to declare bankruptcy. “One of my employees,” Bowerman says, “went from being on paper a millionaire to being hundreds of thousands in debt with no way of payment. There were just dozens of horror stories like that.”

Here it was again: the video game crash, 1983, Williams having to lay off almost everyone at Sierra. It was happening again, and this time because of what Williams had done to prevent its recurrence. “A lot of these people were there because of me,” he says now. “You know, kick me and I get hurt and get back up or something, but kicking people around me and bankrupting them; that’s not nice, it’s really painful, and multiply that times a thousand people. Gosh, how do you do that? I’m not a particularly empathetic person or somebody that feels others’ pains. But man, that crossed the threshold. That goes into crazy land, just seeing things destroyed. It was the company, it was the shareholders, it was the employees, it was the contractors, everybody got hurt. That’s a level of pain that you just… unimaginable.”

In August 1998, Cendant declared its software business incompatible with its core strategic direction and, in a move that cheered analysts, put it up for sale. A deal was struck in November with Havas, a subsidiary of French telecommunications giant Vivendi, to purchase all of Cendant’s software studios for $1 billion—this time, in cash.

“There were some feelings of relief in thinking that the company was going to make it out of the Cendant mess,” remembers a senior artist with Sierra at the time. “[But] it was another sale to a company no one knew anything about… there was just a heavy sense that something was sure to change.”

Three months later, the majority of Sierra’s staff were laid off and its studios closed, in order to effect a dramatic refocus of Sierra’s efforts away from software development to the internet and online gaming platforms. Don’t worry about it, Sierra assured the public. This is the future. Blizzard Entertainment, Havas’ other acquisition, would reach that future faster and better with its Battle.net platform and World of Warcraft; in 2004, Sierra was shuttered.

“They killed it,” says Williams. “It didn’t die. They killed it.” In a consolatory email sent around that day, he struggled for the right words. “There is really nothing good that can be said.”

And yet this marked also the fulfilment of that golden dream: the Californian dream for which Williams’ parents set out from Kentucky, and the teenaged Williams slung newspapers, initiated himself into the mysteries of computers and courted the fancy girl who lived in the house on the hill. “From the day I was old enough to know what it meant, I dreamed about someday being the CEO of a public company,” he writes. “To me this would represent the pinnacle of success.” It was what he’d told Steven Levy, the author of Hackers, back in 1982, that he wanted: to make enough that he and Roberta could retire at thirty with all the money that they and their children could ever want to spend. They weren’t thirty, but they were close, and he had got them there: retirement.

“The first year after I was no longer part of it, and I wasn’t doing games anymore,” says Roberta, “I went into a year of… I don’t want to say ‘depression,’ I’m not a person that does that. I’m generally more of an upbeat, optimistic type of person. But I would say, I went through a period of, ‘What am I going to do now?’ And sadness. I still feel sad. In fact, just telling you this, I feel sad. You know, I’ve got a lump in my throat just telling you. Sierra was our baby. We loved… and I loved… our company and what we did, and [we were] so proud of it, and I loved my job. For twenty years I had been a computer game designer, and I was no longer that. It was like, ‘Well, now what am I?’ I was only about 42 years old. A little young yet to not have anything to do. What do I do?”

Judgments

On July 20, 2018, Walter Forbes was released from the Federal Correctional Institute, Otisville in New York, a medium-security prison later to be occupied by Michael Cohen, the Situation, and Fyre Festival’s Billy McFarland. Forbes was convicted in 2007—after two mistrials—on one count of conspiracy to commit securities fraud and two counts of making false statements, and sentenced to 151 months in prison and to make restitution in the order of $3.28 billion. The house he’d transferred to his wife was returned to him, by court order, to be divvied up between the government and Cendant. Kirk Shelton was sentenced to 10 years and the same amount in restitution. (Since his release, Forbes, now 77, has remained out of the public eye and did not respond to various and repeated attempts to contact him for this article.)

Forbes and Shelton always maintained they were unaware of the fraud that had been going on at CUC, and while they didn’t convince a jury—at least, not the third one—they have found in Ken Williams, at least, a sympathetic ear. “I’m still not 100% convinced he was guilty,” he says. “The best I can say is I guess he was. It’s just so out of character from the Walter that I saw that it’s tough to believe.”

It is difficult for Williams to reconcile Forbes’ alleged fraud with the kind of person he was: ”an impressive Harvard graduate and a Wall Street hero,” as he writes approvingly, “known to many of the world’s rich and famous.” Did Forbes, he wonders, truly have a jury of his peers, qualified to render judgement on the nuances of corporate finance? It did take three trials for a conviction. Was he thrown under the bus by his employees, who in testifying against him avoided prison themselves?

Yes, Williams acknowledges, Forbes lied to him during the acquisition process, but that’s just “hardball business tactics.” A criminal conspiracy is a different story, and he wants to believe Forbes and Shelton’s side. He always kind of did. “If you were at dinner with Kirk Shelton and talking to him, you would definitely believe him. He seemed an honorable business guy, as did Walter.”

“To this day,” he writes, “I am only 99% convinced that Walter was a crook. It remains unimaginable to me.”

Jerry Bowerman scoffs at this. “Walter is 100% a crook.”

“The laws of accounting in the United States are mysterious,” Al Lowe allows. “You would think things would be cut and dried. It’s just a bunch of numbers. But the way you apply those numbers and the way you name them, and allocate them, is very up for interpretation. I’m sure on some planet, there’s an interpretation that Forbes did nothing wrong. It was just the way he kept his books. Myself, I like to make him a villain. Because he cost me a house, man.”

“I definitely think he’s a crook,” says Roberta Williams. “But remember, Ken is nice. Ken likes to always look on the bright side or the nice side of everyone. In fact, that frustrates me. I mean, it’s a good quality. I think probably more people should have that quality of looking at the bright side. But I think, between Ken and I, I’m probably a little bit more realistic in judging people. I’m more liable to say what I think. Ken likes to hedge his words. He likes to be very careful. And he always wants to be a nice guy [whom] nobody ever thinks anything bad about.”

It is not, to be fair, just Ken Williams who believed—still believes?—in the walking dream of Walter Forbes. Bob Davidson believed it was sensible for twenty people in an office selling coupons over the phone to acquire the world’s foremost educational software developer for a billion dollars. Henry Silverman, a micro-manager fixated on figures, believed it was an unmissable opportunity to merge his billion-dollar business with one whose accounts he wasn’t allowed to see.

All smart people who responded to the same thing in Walter Forbes: an offering of wealth and power by a man who had both. This beautiful man who said to trust him, and in spite of misgivings they did, because they were hungry. And why would it ever seem like a lie, when you think someone like Forbes—Wall Street, Harvard, C-suite—is exactly the kind of person who is supposed to have billions of dollars? Of course Forbes should have it; of course, they should too. This was the way it was supposed to work. We get bigger.

Vision

In 1998, before the fall, Ken Williams passed on a personal offer from Jeff Bezos to help develop Amazon, for his own venture, WorldStream, that would bring talk radio to the internet. Jerry Bowerman followed him. “He is the only visionary I’ve worked for,” Bowerman says.

What do you think, Williams asked Bowerman, about Walter Forbes, as an investor? Forbes was not yet a disgraced convict, just the man who’d lied to Williams and by neglect pushed him out of Sierra and CUC.

“I’m like, are you out of your mind?” says Bowerman.

Forbes came by for the meeting, handing his jacket to Bowerman. You’ll like this, Williams pitched him. Talk radio, on the internet, with the technology underpinning it also supporting remote business communications. Hundreds of people on a call together, on the internet. They already had it working.

This was the future, Williams believed, and he still saw Forbes as his kindred spirit. Hadn’t he and Forbes always been on the same page about the internet? The Sierra Network, NetMarket, online shopping, and now this?

Forbes watched the demo with noticeable disinterest. Williams was unsettled: the two of them, Forbes and Williams, everyone had always said they were visionaries. We look at the horizon, Williams thought, and we see the same thing. Don’t we see the same thing?