You might be surprised to learn that Palantir, a company that helps ICE separate and deport families with its technology, is one of the most popular meme stocks traded by online retail investors. Because of this, online traders celebrate new ICE contracts, for example, and now some are stoked about the company showing up amid the Russia-Ukraine war.

The surveillance software company co-founded by far-right billionaire Peter Thiel and self-professed progressive CEO Alex Karp has been a darling of communities like Reddit’s WallStreetBets for nearly two years now—the subreddit refers to Karp as “Papa Karp” and is flooded with a litany of memes celebrating its various spikes, bemoaning crashes, and mocking anyone who didn’t invest at the right time.

Videos by VICE

On June 2, Karp became the first chief executive to meet with Ukrainian President Volodymyr Zelenskiy since Russia invaded the country three months ago. Mykhailo Fedorov, Ukraine’s minister of Digital Transformation, posted a photo of the meeting and confirmed in a tweet that Karp was not only the first CEO to visit since the invasion, but demonstrated “Impressive support and faith in credibility of investments: agreed on office opening and digital support of Army.”

As for what that actually means, it’s not entirely clear. “Dr. Karp and President Zelenskyy discussed how Palantir can continue to use its technology to support Ukraine. With geopolitical tensions rising all over the world, enhancing security and protecting democratic institutions has never been more important,” Palantir told Bloomberg in a statement.

Traders on Twitter were excited at the news, praising the company for the move. “$PLTR LEADER does LEAD. $PLTR makes me proud to be a shareholder,” one user replied to Fedorov’s tweet. Another user was even more excited: “This is why I’m invested in palantir!!! I’m buying the dip all the way down!!”

A similar sentiment took hold on Youtube in the comments to one trader’s recap of the visit. “Makes me proud to be a shareholder. Love this company,” one commentator replied on Youtube. Others could barely hide their excitement, with one reply reading: “PALANTIR TO THE MOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOON!!!!!!!!!”

Meme stocks conjure up an image of young, extremely online traders scrambling to shoot company’s share price to the moon, or to drop it like a meteorite. That image is largely correct: It’s best to think of meme stocks as stocks that are incredibly popular with a specific group of extremely online traders—Gamestop, AMC Entertainment, and Tesla—and trading based on sentiments that can be tracked through social media and is incredibly sensitive to news developments.

When short seller Citron Research announced it was shorting Palantir, the WallStreetBets subreddit entered a frenzy and proudly doubled down on their favorite stock in a bid to pump its share price. Investors helped push the stock from its IPO price of $10 to as high as $50, but have been wiped out with the stock’s steady decline: it currently sits at $8.90. Back in June 2021, Motherboard spoke to traders who lost tens of thousands of dollars—some reportedly lost their entire savings, others in the community reported eye-watering six figure losses that threatened to ruin their entire lives.

Now, Palantir contracts are closely followed, Papa Karp’s words are closely scrutinized, and its every move considered as retail traders decide whether to pump or dump the stock.

Understandably, WallStreetBets was less optimistic about the Ukraine news than Youtube and Twitter. “Only thing getting hammered worse than Ukraine are my PLTR bags,” one trader replied to a Reddit post announcing the visit and insisting it would be good for the stock since Palantir could position itself for more contracts thanks to increases in defense spending and aid.

Other investors chimed in when there were attempts to offer optimism. “Hahaha really……Are you that desperate…..Pltr is a penny stock, nothing else,” another Redditor said in response to an attempt to analyze how Palantir’s stock (around $9.30 as of the visit, currently $8.90) could benefit from this.

Others still simply warned off traders from touching the stock, still licking their wounds from last year’s unsuccessful attempt to pump the price. “Please for the love of everything WSB stay away from this,” one Redditor added. “Just let this company do its thing, get it[s] contracts over the years and not make it a meme again. We all know what happened last time.”

More

From VICE

-

Photo: Gandee Vasan / Getty Images -

Photo: duncan1890 / Getty Images -

Photo: Jorge Garc'a /VW Pics/Universal Images Group via Getty Images -

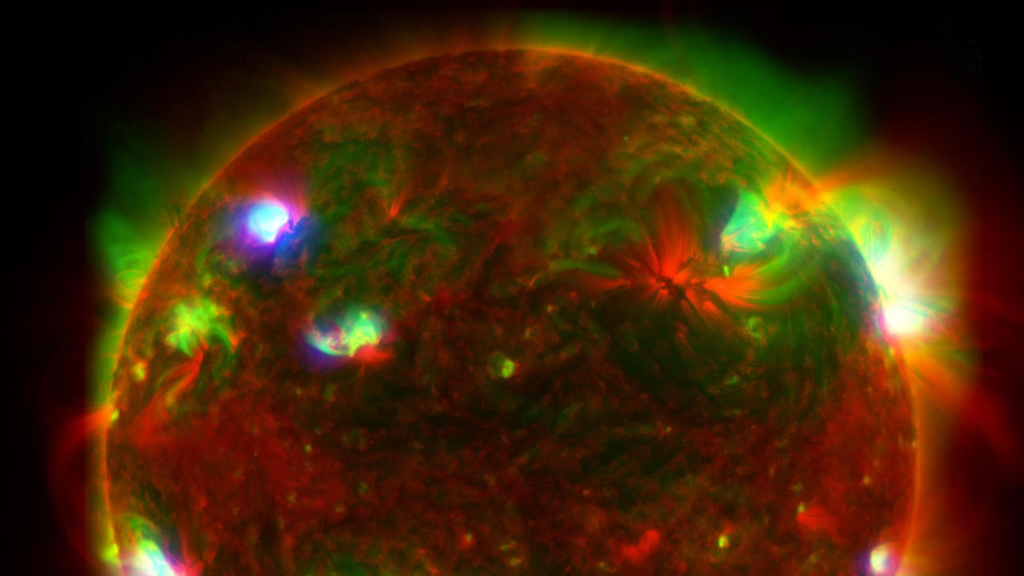

Three-Telescope View of the Sun. Photo: NASA