A few years ago, I quit my job and was presented with two options: Keep the pension I’d accumulated in a pot somewhere, or withdraw it. The total amount? About £600 – almost enough to cover one month’s rent. As someone of a generation for whom the idea of a comfortable retirement is an utter fantasy, it was the easiest decision of my life.

If I explained this thought process to anyone in the FIRE movement though, I imagine they’d shake their heads in disappointment. FIRE stands for “Financial Independence Retire Early”. The online community emerged in the early 2000s, but has exploded in recent years. As the economy lurches and creaks around us, who wouldn’t like the idea of stashing away vast sums of money in your twenties, then quitting work forever?

Videos by VICE

What’s surprising is the number of people who have actually managed to achieve this dream, through rigorous savings and investment regimes. Some FIRE devotees profess to put away over 70 percent of their earnings, until they reach the sweet spot: A nest egg of at least $1 million.

Five years ago, VICE spoke to a handful of those who were embarking on this early retirement journey. At the time, all of them glowed with glee about their new-found freedom. But the thing about wild schemes and dreams is that things don’t always work out the way you hoped. So, we decided to check in and find out whether their fantasies were materialising, or if their FIRE plan had gone up in smoke.

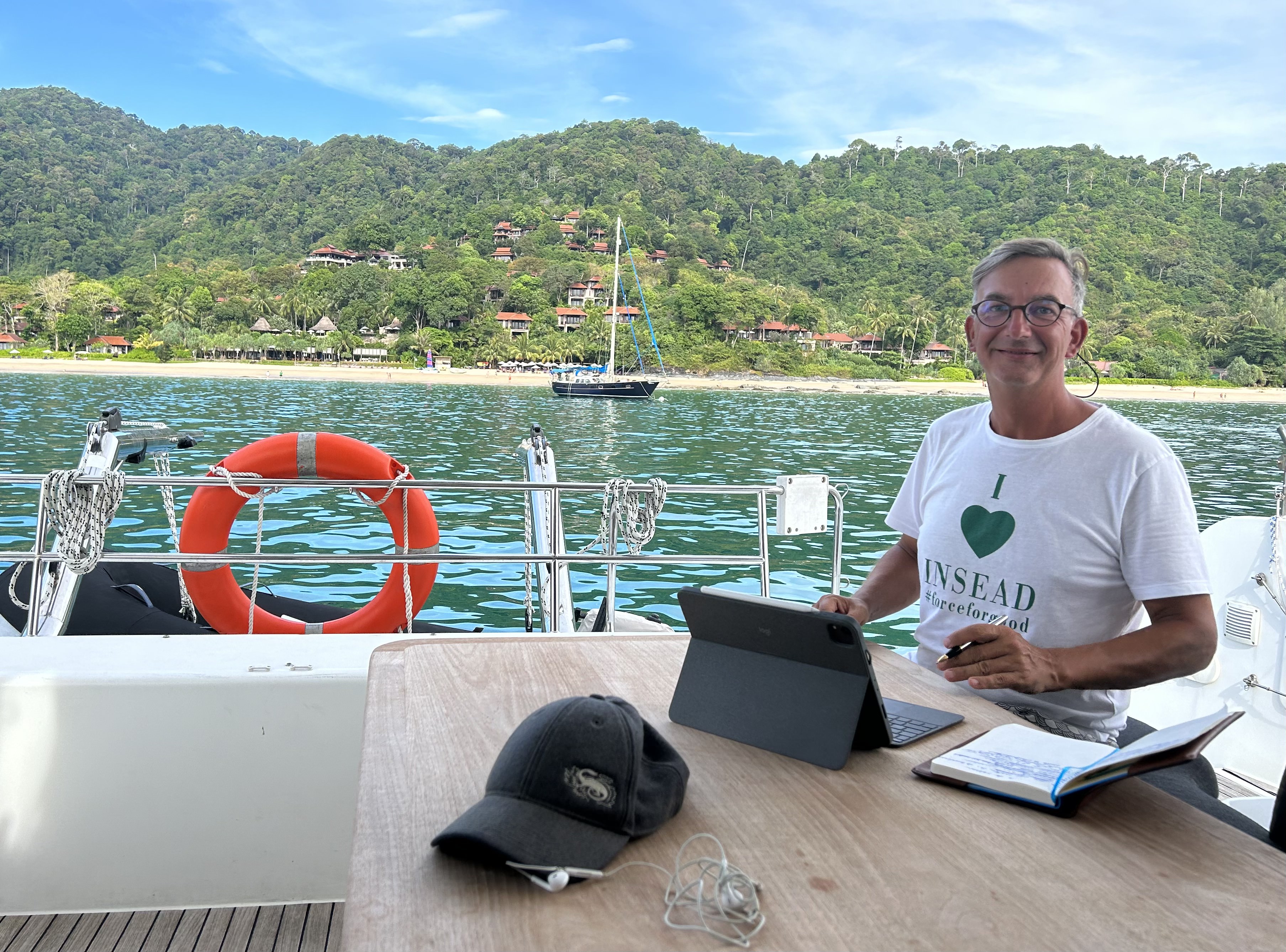

When I ask Abel van Staveren if he has any regrets about retiring in his mid-40s, he tells me he and his wife are currently anchored off the Thai island Ko Lipe. “Our life revolves around sailing full time,” he says. “We no longer have a house or a car, but we have two liveaboard sailing boats.” In the summer, they cruise around north west Europe. “We spent last year on the UK south coast, all the way to the Isles of Scilly, and this year we sailed to the Baltic,” he says. “In the winter we mainly cruise Thailand and Malaysia and all the tropical islands in between.” So, they’re not bored then?

“Life on an offshore cruising sailboat is never dull,” Abel says, plainly. “Scenery is always changing. You can moor up in St Catherine’s Dock next to Tower Bridge and enjoy the buzz of central London, and a week later be anchored in a serene river on the Isle of Wight surrounded by seals.” From my vantage point in South London, neither of these things seem all that exotic, but, for Staveren, the location isn’t really the point. “The main motivator was freedom,” he says. “We wanted to do what we wanted, where we wanted, with whom we wanted, when we wanted.” It’s quite the FIRE movement mantra.

Looking back on his working life, Staveren says he was “a corporate salary slave in London, Singapore and Zurich” – the exact opposite of freedom. “Time is just too valuable for that,” he says. “Money comes and goes, time just goes.”

Having said that, he’s not actually all that concerned about money “going”. “We have the reverse problem [to what] many FIRE people have,” he says. “We find it hard to spend. After saving and being frugal all your life it’s hard to switch that around to spending more. But that is what we need to learn.”

Back when we spoke to Steve Adcock, he was 35 and had just retired with more than a million dollars. Now in his early forties, he says the past seven years have been “better than [he] ever could have imagined”. His only regret? “Not retiring even sooner,” he says.

Freedom is the first thing Adcock brings up, too. “Controlling your time and almost everything you do during the day is a freedom unlike any other,” he says. For the first three years of their retirement, he and his wife travelled the US in an Airstream van. “It was a fantastic experience, but ultimately, it wasn’t the best long-term solution for us,” he says. So, in 2019, they bought an off-grid spot in the desert. “I call it our ‘off-grid recession-proof house’,” he says. “We haven’t paid a power or water bill in years, as we have solar [power] and a water well on-site.”

Adcock is adamant that retirement isn’t all endless leisure though. “Most early retirees don’t just sit around and do nothing,” he says. “They are very active and engaged in what they care about the most.” And, of course, financial independence gives them the time and opportunity to pursue all their passion projects.

“Today, I use the term ‘retire’ loosely because I’m still very active in the personal finance community,” he says. “I’m building one of the biggest money-related newsletters on the planet, I’m very active on social media, and I’ve just started a live podcast with a friend of mine.” He adds: “My wife and I are flexible and will do whatever we must to maintain our lifestyle.”

All of this means that their “nest egg” is looking remarkably healthy at seven years old. “We aren’t touching our investments nearly as much as we anticipated because, much to our surprise, there are so many opportunities to make money after quitting your full-time job,” he says. “I’ve turned down more job offers than when I worked for a living.”

While the community might advocate for frugality then, what the FIRE retirees really seem to prove is the old adage: “Money begets money”. Put plainly, once you’ve got a million to work with, it seems there are ample opportunities to keep the total ticking ever upwards, without having to resort to getting anything as prosaic as a full-time job. This has certainly been the case for 40-year-old Kristy Shen and her husband Bryce. They’ve now been retired for nearly nine years – slightly longer than they worked.

“Since we retired, our portfolio has gone up,” Shen tells me. “Not only that, now that we’re in a high inflationary environment, our dividends have risen past the increase in our cost of living.” Not that their cost of living has increased all that much – as she puts it, “When you no longer need to work, rising gas prices don’t affect you since you no longer need to commute to work. Plus you have more time to cook, so you can save money on eating out.” All this means that, far from running out of money, their portfolio has actually doubled in value since 2015. “So yes, we have enough to stay retired forever,” Shen says.

Like Adcock, Shen says she’s never been bored. “There’s so many things to do! When we weren’t travelling, we started a whole new career as authors, and now we have a new baby, so life has been incredibly full and rewarding, not boring at all.” As fun as travelling the world has been, Shen says it wasn’t until this year that she and her husband learned the true value of financial independence. “Sadly, my father-in-law passed away from brain cancer and because of FIRE we were able to drop everything and basically move in to take care of him,” she says. “This would’ve been impossible while working.”

On top of that, they had a newborn. “So while my husband was coping with the loss of his father, he was also learning how to become a father himself,” Shen says. “Life is strange that way.” As turbulent as the year has been, the freedom to prioritise family over work has made her even more grateful for having joined the movement. “That’s the best thing about it,” she says.

Personally, I can’t help seeing the FIRE movement as advocating for the obscene hoarding of wealth for a tiny minority. But, when I hear early retirees championing how it allows them to care for sick relatives or young children, or to just develop hobbies and passion projects, it makes me think how sick the world of work is. Back when we first spoke to Shen five years ago, she told us she’d stumbled across the FIRE movement after having stress-induced panic attacks at work, and had recently witnessed a colleague being stretchered out of the office after collapsing at their desk. Is it any wonder that people are drawn to financial communities of this kind, when full-time work seems increasingly broken?

“I’m a huge fan of fixing our existing five days on / two days off work arrangement,” Adcock says, when I raise the question of reforming work. “Most of my career was spent sitting at a desk to fill my required eight hours a day quota,” he says. “We weren’t put on this earth to spend 50 of our most productive years behind desks or suffering in suits for the almighty dollar. That’s not my definition of living.”

More

From VICE

-

(Photo by Max2611 / Getty Images) -

Photo: MediaPunch/Shutterstock -

Screenshot: Six One Indie -

Screenshot: Ubisoft