The Consumer Price Index, a key inflation gauge that tracks the prices of products many Americans regularly buy, has seen its growth rate slow the past several months until it signaled inflation had sunk below the Federal Reserve’s target of 2 percent.

And a big reason for that is your mobile phone bill.

Videos by VICE

The ongoing price war between mobile-service providers has been great for consumers — there’s also been a resurgence of unlimited-data plans — and it’s it’s also played a big role in curbing CPI. The drop in the price of data plans, which are one of the products tracked by the CPI, has raised eyebrows both on Wall Street and at the Federal Reserve, which many analysts expect to raise its key interest-rate target next week.

Such a move would help prevent inflation, but it would also nudge up borrowing costs for everything from credit cards to mortgages. If the central bank hikes this week, even while CPI is still relatively weak, it would effectively be acting to prevent a problem that doesn’t yet exist.

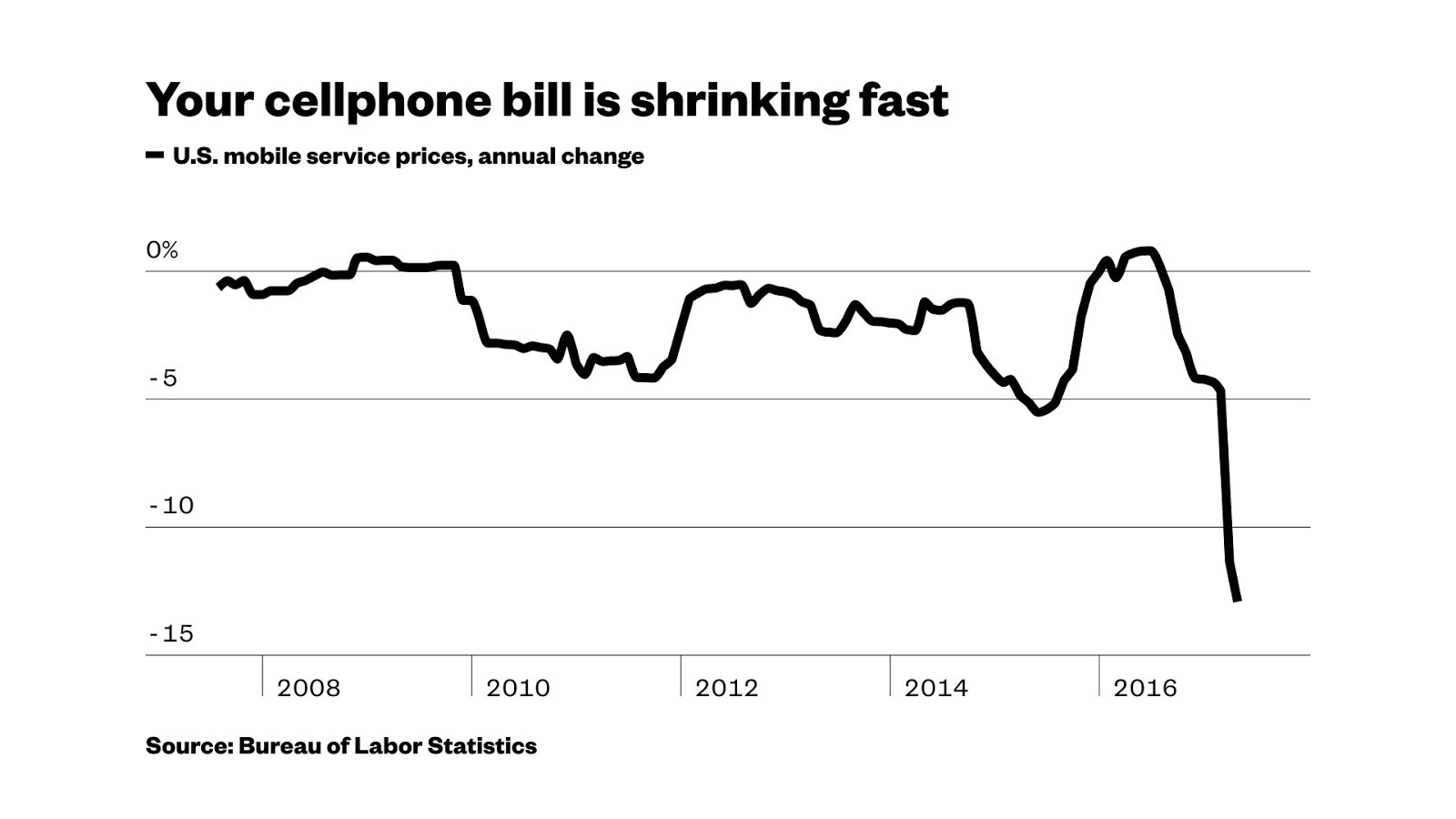

Data plans are a poster child for the low-inflation status quo in the economy as a whole. According to the CPI data, the cost of mobile services in the U.S. slid 13 percent in April compared to a year earlier, the biggest drop in 16 years. And that’s just the latest chapter in a shift in the mobile industry that’s been underway for awhile. Just take a look at the monthly change in prices for data plans over the past decade:

As usage of mobile devices has skyrocketed, the mobile companies have had to compete more fiercely for users — and not just by trash talking one another. They’re offering better deals and even accepting lower profit margins (for now) in order to attract more customers in the near term.

T-Mobile started the industry price war in 2013 by eliminating two-year contracts and moving to a month-to-month fee structure that at the time was cheaper for many users. Sprint and AT&T followed suit with unlimited offerings of their own, and all the carriers have been gradually tweaking prices and the features included in various plans ever since.

The longest holdout in the unlimited-pricing trend was Verizon, which not coincidentally was the carrier with the most subscribers by far at the outset of the price war. But frightened by its rivals’ gains in signups, even Verizon cried uncle in February, offering an $80 per month plan with unlimited data, calls, and texting.

And so now, all four major U.S. carriers are simultaneously offering some form of unlimited pricing for the first time in seven years. The price war has reached its “inevitable apex,” industry consultant Chetan Sharma wrote in a recent research note.

He also pointed out that the increased competition has taken its toll on companies: 2017’s first quarter saw data revenue for the U.S. mobile industry as a whole fall for the first time since the turn of the century.

To boot, carriers have essentially abandoned the old practice of subsidizing the cost of new smartphones, pushing that entire expense onto customers. That has helped curtail upgrades, as people in the U.S. and many other major foreign markets have started using the same devices for longer periods of time, according to tech research firm Gartner. It’s part of the reason why sales of the iPhone and other popular models have been falling lately.

All of this price-cutting and belt-tightening doesn’t indicate the U.S. economy as a whole is about to overheat. But no one, including officials at the Fed, seems to believe the current status quo can last — and that includes your low phone bill.

Cleveland Fed President Loretta J. Mester touched on the topic of mobile services in remarks to the Chicago Council on Global Affairs on May 8. She noted that inflation has long been running below the Fed’s 2 percent target, but added, “I’m taking little signal about the future path of inflation from those numbers. They partly reflected some one-off changes, such as the decline in prices for cell phone service plans, and they came after strong readings in January and February.”

Translation: Higher interest rates are probably in our future despite low inflation now. Better text your friends.