Nick Hawthorne has had a rough couple of years. The 37-year-old film professor at Montana Tech found out at Christmas that not only is he not getting tenure, his entire department is being eliminated. Fresh out of a teaching job and more than $66,000 in debt from his own degree, he’s so desperate for a financial savior that he’s repeatedly hit up the Ellen show in hopes of prostrating himself before the talk-show host and her audience.

He knows that it’s a long shot—he thinks his story isn’t quite sad enough. Like thousands of Americans, Hawthrone thought he was on a repayment plan that, after 10 years of on-time payments, would wipe out the remainder of his loans. Two years ago, he was told that he’d been on the wrong payment plan all along and didn’t qualify for the debt forgiveness he’d been counting on, and now feels misled by his loan servicer, Fedloan. While Fedloan hasn’t been sued by multiple states and the Consumer Financial Protection Bureau like its rival Navient has, for allegedly confusing borrowers about how to pay back their debts, Hawthorne feels as if the company cruelly withheld information and destroyed his chance at homeownership.

Videos by VICE

“My heart sank when I found out,” he said. “I broke down crying in my office. I was hoping and praying that my debt would be forgiven, and now it feels like I’m in the fucking Twilight Zone.”

Despite paying every month for about five years, an interest rate of above 6 percent sucks up about two-thirds of his $300 monthly payment, and he’s only managed to touch about $1,200 of the principal of his debt. Now he has to start all over again. He might be able to someday take advantage of the government’s public loan forgiveness program, which is supposed to help people with civic-minded jobs like teachers, but has so far provided help to only a few. Beyond that and Ellen, though, he has another hope: If the right candidate defeats Donald Trump, it could lead to a law erasing all or most of the debt hanging over his head.

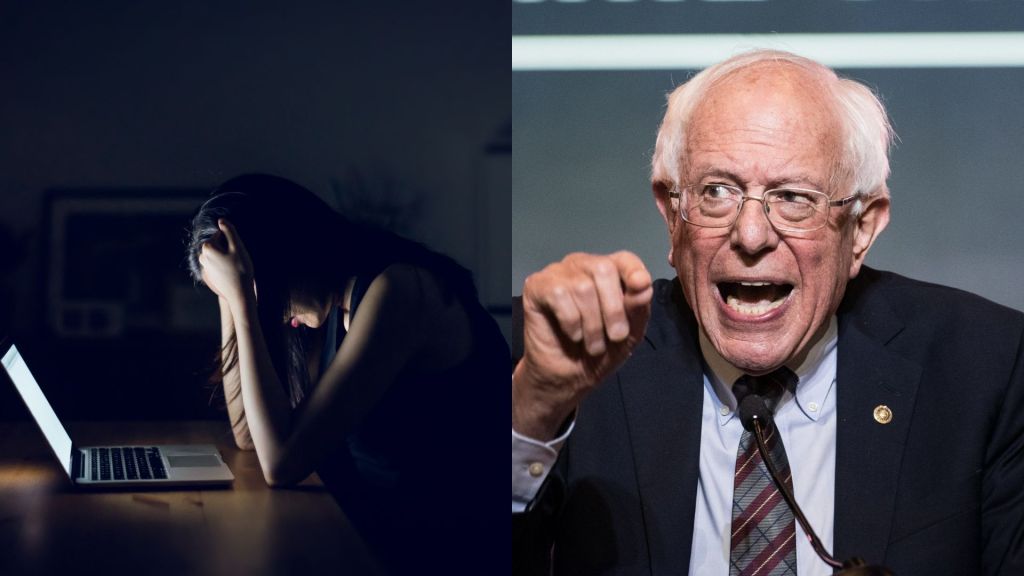

When Elizabeth Warren and Bernie Sanders, the leading left-wing candidates in the Democratic 2020 primary, said they were in favor of massive debt cancelation, it pushed what used to be a fringe idea into the mainstream discourse of the Democratic Party. Sanders’s in particular is a far-reaching plan that would eliminate more than $1.6 trillion in student debt and make public universities tuition-free, at a cost of $2.2 trillion over 10 years. But these proposals have set off a huge debate.

Debt cancellation opponents have long held that these benefits force average taxpayers to pay for the decisions of those fortunate enough to have gone to college. Some have also said that the Sanders plan, which calls to cancel the loans of all student debtors, regardless of income, is too favorable to people like doctors and lawyers who make even more money than the typical college graduate. But as people are nitpicking cancellation plans and the ideology behind them, regular people crushed by their debt loads are praying that debt cancelation comes to pass.

“You bet your ass I would take that money,” Hawthorne said. “I understand that yes, it was my decision to take out the money, but that debt crushes my paycheck. I can’t afford a house and I’m living paycheck-to-paycheck because of the interest. It’s literally killing me.”

During Thursday night’s Democratic debate, student loans came up, with young candidates Pete Buttigieg and Andrew Yang both proudly declaring they had six figures of debt to contend with. Buttigieg, who has emphasized his millennial credentials on the issue, said he wanted student debtors to be able to refinance their loans but wouldn’t go as far as Sanders, saying, “I just don’t believe it makes sense to ask working-class families to subsidize even the children of billionaires. I think the children of the wealthiest Americans can pay at least a little bit of tuition.”

The South Bend mayor sounded more than a little bit like the young Washington Post writer who recently published an op-ed in which he claims he wants to pay off his loans himself. “Students pay for school because they think it’s a worthy investment, and most of the students find that to be the case,” he concluded. “For them, there’s no reason for the government to pick up the tab.” (There’s also this person writing for Fox News who’s $500,000 in debt and ranting about how people need to take personal responsibility for being caught up in what’s probably an economic bubble.)

Krystal Abraham, a 30-year-old banking professional who got her undergraduate and master’s degrees in New York and has since moved home to Canada, disagrees. She’s trying to take advantage of a loophole that allows for people outside the U.S. to make payments of $0 on their student loans through something called the Foreign Earned Income Exclusion tax credit. Abraham, who has about $60,000 in debt, said that there was no way she could make her $800 monthly payments while still living in the U.S., and said that the author of the Post article is likely too young to realize that sometimes people get hit with unexpected medical bills or face some kind of emergency that makes it impossible to meet their obligations.

“Sometimes life happens, said Abraham, who would consider leaving Canada, invest more money into her home, and buy stock if a debt forgiveness bill got through Congress.

“If you want to pay it back, go ahead,” Abraham said. “But don’t try to take that quote-unquote handout away from anyone else.”

For his part, Hawthorne is now in forbearance, meaning he’s gotten permission to pause paying his debt for a short period of time until he can get another job. Right now he’s looking at adjunct teaching gigs—low-paying academic work that comes with no benefits and no real likelihood of being able to make headway on what he owes. He’s getting married in September to a woman who also has about $30,000 in outstanding student loans herself, and while he envisions having a family with her, he can’t imagine encouraging his future children to go anywhere but a trade school unless he digs himself out of debt. He’s hoping the government swoops in with a shovel and passes a debt forgiveness bill, something that seems only slightly more likely than his getting on Ellen, though it’s the only chance he feels he’s got.

“If we bailed out the big banks, why can’t they do it for people who are trying to better themselves and get an education?” he said. “I hate to put all my eggs in one basket, but I need a miracle.”

Follow Allie Conti on Twitter.